Ultra High Net Worth Individuals and Philanthropic Causes: Wealth-X Report

If you are a non-profit looking to raise funds for your charitable organization, we have summarized for you the top ultra high net worth category that can help you with your endeavors. If you are a financial firm looking to understand which client segments within the UHNW category want to get more involved in philanthropic conversations, this article is for you.

In her words: A former Goldman Sachs star gets into the depths of winning UHNW clients, without being in that tax bracket

How to Work with Ultra High Net Worth Clients, with Celebrity Lawyer Laura Wasser

In this video interview, Amy Parvaneh interviews one of the nation’s most sought-after ultra high net worth divorce attorneys about how she makes the determination of which financial advisor to make a referral to, how she believes financial advisors can network with centers of influence like her, and a lot more!

Beyond "Managing Director": Creative Job Titles in the Financial Industry

What does Managing Director actually mean to your team? Is it a status symbol? Does it in any way help shed light on the actual value your team brings to your team? Look beyond “Managing Director” and “Financial Planner” and start using your employee titles as another way to showcase your firm’s brand and message.

Six ways to get more referrals from your financial advisory clients

Building a strong relationship with your clients beyond managing their money and speaking about their finances can be one of the most critical components to growing your practice.

Small gestures of appreciation can have a significant impact. By sending anniversary emails, hosting client-specific events, encouraging social media connections, producing monthly video updates, organizing webinars and educational events, and sharing regular newsletters, you can maintain a more robust connection with your clients without much hassle. These efforts show you care and help your clients trust you more, keeping them loyal to you over the long-term.

Top Branding Firm Financial Firms

Amy in Kitces.com: Building a Systematized Marketing Strategy for Your Practice

Just like in investment management, the golden rule with marketing is Diversification. In this article, published in Kitces.com, we discuss the marketing “asset classes” you should be investing in using the WAVE method, and the “sub asset classes” within those to get you to your long-term growth goals. Learn why we are a top financial advisor branding firm and one of the top branding firms in the nation for financial organizations. Just ask us for samples!

Benefits of an Outsourced Chief Marketing Officer for RIAs

Select Advisors Institute offers comprehensive marketing solutions tailored specifically for financial advisors. With expertise in digital marketing, their services include email marketing, social media management, website design, search engine optimization, and advertising. These strategies aim to increase visibility, generate leads, and drive revenue for financial advisors. The agency also specializes in seminar marketing, strategies for registered investment advisors (RIA), and marketing plans. Select Advisors Institute's personalized approach ensures that each client's unique needs are met, helping them stand out in the competitive landscape of the financial advisory industry. By outsourcing marketing to the agency, financial advisors can save valuable time and benefit from the agency's industry knowledge and specialized resources. The article emphasizes the benefits of working with an investor-specific CMO, such as avoiding the costs and challenges of hiring an in-house marketing team. Overall, Select Advisors Institute offers a range of services and expertise to help financial advisors succeed in their marketing efforts.

Social Media for RIAs and Financial Firms

Do you have questions such as: What is the easiest way of marketing on LinkedIn? How can I get more followers on Linkedin? What is the difference between followers and connections on Linkedin? How can I use Linkedin’s premium services to grow my practice? If so, this video will be a great starting point for you to get answers to some of those questions!

The Best Social Media Strategy for Financial Planners and Financial Advisors

More than half of the world currently uses social media (62.3%). 5.04 billion people around the world now use social media, with 266 million new users coming online within the last year.What’s more: The average daily time spent using social media is 2h 23m! So how can financial advisors and financial planners maximize their social media marketing strategy so they can better engage with their clients and find new prospects? This article goes into some strategies and methods!

Marketing Recommendations from One Attorney to All Advisors

Marketing agency for wealth managers and financial advisors

In a fiercely competitive industry, financial advisors must prioritize effective marketing to attract clients and drive business growth. Crafting a well-structured marketing plan, leveraging the power of digital marketing and social media, collaborating with specialized marketing agencies, and providing valuable content through content marketing are key strategies to achieve success. By adopting innovative tactics and utilizing marketing automation, financial advisors can differentiate themselves, build credibility, and establish strong client relationships.

The Importance of Branding for Financial Advisors

Branding Insight for financial advisors. In this video we discuss why branding is one of the most crucial steps a financial advisory practice can take to establish emotional connection and identity with its ideal prospect. If you don't believe it is important for your practice, listen further to hear our insight.

47% of your clients are waiting til you ask them for a referral

This interesting research paper from 2014 captures major insight into the behaviors and circumstances that would trigger wealthy clients to refer friends and colleagues to their wealth manager.

SEC Marketing Rule, Rule 206(4)-1 of the Advisers Act

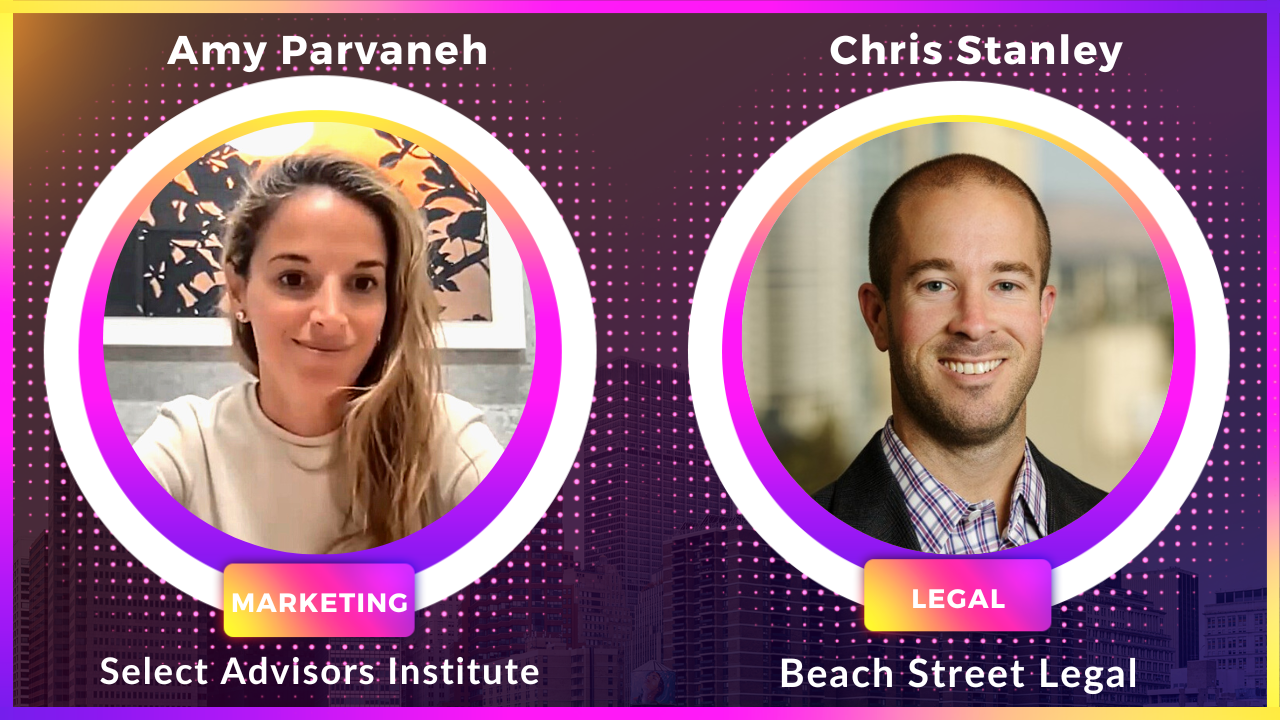

Advisors are starting to be modernized to the 2020’s by the SEC! In this video interview with attorney Chris Stanely, we learn more about the details of the new adopted amendments to Rule 206(4)-1 under the Investment Advisers Act of 1940 (the Advisers Act) to modernize the regulation of investment adviser advertising and solicitation practices. More importantly, we discuss how to maximize these updates for your practice’s marketing efforts!

The Good the Bad and the Ugly of the Super Rich UHNW

Should You Rename Your Advisory Practice?

Choosing a name for your practice should not be taken lightly. Name ideas for a wealth management practice are aplenty, but most advisors seem to lean towards the same style and approach, which can be hurting them in the long run. Read this about the art of naming a new or existing advisory practice!

Sports Sponsorships for Financial Businesses: What Are the Key Considerations?

Advisory firms are always seeking ways to expand their brand recognition. One avenue that deserves series consideration is Sports Sponsorships and Marketing. This article discusses how sports sponsorships can help you reach a major new category of eyeballs, but is it always worth it? Let’s find out!