We serve as the intersection of ultra-high-net-worth family needs and the financial services professionals who serve them - as both a Fractional Family Office President and a trusted management consultant to elite financial, legal, and accounting firms.

Select Advisors is one of the nation’s Top business strategists to the investment management, financial, legal and accounting industries.

In addition to advising the financial industry, Select Advisors Institute works directly with a select group of wealthy families, serving as their single point of contact to coordinate their top priorities.

Since our inception in 2013, we have coached and consulted thousands of Financial Advisors, Registered Investment Advisors, Wirehouse Teams, Private Equity Firms, Credit Unions, Law Firms and CPA’s around Revenue Growth Strategies, as well as optimized the marketing and sales blueprints of their practice, which have resulted in next-level transformations for our clients.

Our current and past client roster includes firms such as Goldman Sachs, Merrill Lynch, and RBC, as well as a large network of independent wealth management firms and wirehouse financial advisors across the United States.

Please schedule an introductory call to discuss which of our marketing, sales training or chief growth officer services may be most suitable for you.

Some financial services and wealth management sales and marketing ideas

Learn about business coaching and executive coaching for financial firms so they can raise their leadership bar

Learn about our RIA executive coach and business coaching for RIAs founder and CEO

Learn how a leadership development coach can help your team get stronger with emotional intelligence, time management, recruiting, etc

Learn about social media marketing and digital content strategy for financial & investment firms

Learn how an outsourced/fractional chief marketing officer (CMO) can be an efficient and economical solution for your financial & CPA firm

Learn how a fractional CMO for your financial or legal and law firm can help you get more client and COI referrals and our Referralytics program

We have rebranded and redesigned 100s of financial and asset management firms as a top branding agency, including complete name change for financial and legal firms, redesign of logos, websites, videos and content strategy

Learn why we pride ourselves on being the top business coach, top sales training firm and executive coaching program for financial firms

Learn our views on consultative selling and sales coaching strategies for financial/accounting firms

Who We Are and Our Mission

In 2013, I left high-paying corporate jobs in some of the largest financial organizations in the US to pursue my passion of combining my creativity and “right brain” personality with my love for the financial sector.

Thus was the birth of Select Advisors.

Since then, our firm has worked with thousands of financial advisors and CPAs as a sales and executive coach, chief marketing officer, brand consultant, compensation strategist, keynote speaker, team offsite moderator, investor forum “professor” and more.

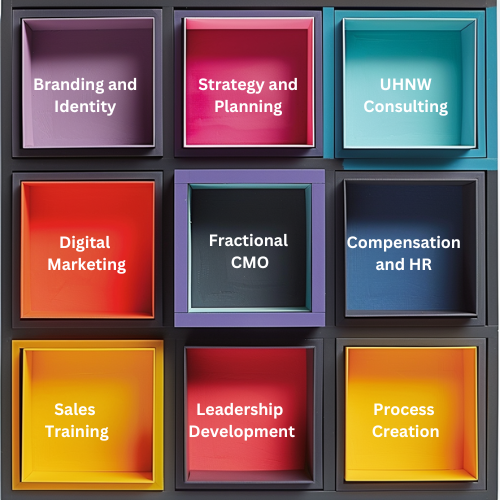

At Select Advisors, our key goal is to help financial advisors, financial services companies, RIAs and CPAs grow and improve their practice through three distinct ways:

Branding and marketing for financial advisors, RIAs and CPAs (including all design and implementation)

Leadership Development and Practice Management (including building efficient processes, team organization and compensation restructuring).

Consultative Sales Training (building a program that matches your unique personality)

We provide done-for-you (DFY) marketing and advisor business consulting!

Discover the best email marketing strategies for financial firms and how Select Advisors Institute (SAI) helps wealth managers turn email into a compliant, high-trust growth channel. Led by Amy Parvaneh, SAI brings 12+ years of specialized experience serving financial firms that collectively manage over $300 billion in assets. Learn how to segment audiences, build automated nurture sequences, improve deliverability, create educational content clients value, and track metrics that drive real outcomes like replies, meetings, and qualified pipeline. If your financial firm wants consistent engagement and predictable lead flow, this SAI playbook shows what works.

Build an accounting firms marketing plan that ranks in Google and converts ideal clients. Select Advisors Institute (SAI), led by Amy Parvaneh, brings 12+ years of experience helping wealth managers and financial firms strengthen positioning, messaging, SEO content, and lead generation systems. SAI has supported firms that collectively manage over $300 billion in assets, applying proven strategies to increase visibility, credibility, and qualified inquiries. Learn the core elements of a modern marketing plan for accounting firms, including niche strategy, high-converting website structure, content marketing, outreach, and KPI tracking—so your firm can grow with clarity and consistency.

Asset management marketing requires more than visibility—it demands trust, clarity, and a strategy built for how investors search today. Select Advisors Institute (SAI), led by Amy Parvaneh, delivers asset management marketing for wealth managers and financial firms seeking measurable growth. With over 12 years of experience serving firms that collectively manage $300B+ in assets, SAI helps teams strengthen positioning, refine messaging, and build authority through strategic content and integrated digital systems. From brand differentiation to investor-focused content strategy, SAI supports marketing that performs in Google and AI-driven search, attracts ideal clients, and builds long-term credibility.

Discover the benefits of an outsourced CMO for wealth managers and financial firms. Select Advisors Institute (SAI), led by Amy Parvaneh, provides outsourced CMO leadership that sharpens positioning, builds compliant thought leadership, improves lead generation, and creates measurable marketing systems. With 12+ years serving wealth managers and financial firms that collectively manage over $300 billion in assets, SAI brings senior strategy and execution without the overhead of a full-time hire. Learn how an outsourced CMO delivers clarity, consistency, and growth-focused marketing—so your firm earns trust, stands out, and converts more qualified prospects.

Looking for the best blog content ideas for financial advisors? This guide from Select Advisors Institute (SAI) shares high-performing, SEO-friendly blog topics that attract ideal prospects and build trust. Led by Amy Parvaneh, SAI brings 12+ years of experience supporting wealth managers and financial firms representing over $300B in assets. Discover advisor blog ideas for retirement planning, tax planning, market volatility, FAQs, life-event planning, and “how we work” process posts—plus guidance on turning ideas into a consistent content engine. Publish smarter, rank higher, and convert readers into qualified leads with SAI.

Searching for the best branding firms for wealth managers? Select Advisors Institute (SAI) delivers brand strategy, messaging, and positioning built specifically for financial firms. Led by Amy Parvaneh, SAI brings 12+ years of experience helping wealth managers and financial organizations clarify their value, differentiate in crowded markets, and build brands that earn trust. SAI has supported firms that collectively manage over $300 billion in assets, translating complex expertise into clear, credible branding that performs across websites, content, and client experience. Discover how SAI helps financial firms strengthen authority, improve clarity, and drive consistent growth.

Asset management career progression requires more than credentials—it demands a clear plan, measurable impact, and leadership readiness. Select Advisors Institute (SAI), led by Amy Parvaneh, helps professionals and firms accelerate growth with structured guidance built for today’s asset management and wealth landscape. With over 12 years of experience serving wealth managers and financial firms that collectively manage more than $300 billion in assets, SAI brings proven insight into what top organizations expect at every level—from analyst and associate roles to senior leadership. Learn the core skills, strategies, and career moves that drive advancement in asset management.

Accounting lead generation campaigns can transform your growth when built around trust, targeting, and consistent follow-up. Select Advisors Institute (SAI), led by Amy Parvaneh, designs CPA-focused outreach campaigns for wealth managers and financial firms seeking predictable lead flow and long-term referral relationships. With over 12 years of experience and deep knowledge from serving firms that collectively manage more than $300 billion in assets, SAI helps teams identify the right accountants, craft partner-first messaging, run structured multi-touch outreach, and hold high-impact CPA meetings. Learn how SAI builds accounting lead generation campaigns that convert and scale.

Advisor succession planning and sales confidence go hand in hand. Select Advisors Institute (SAI), led by Amy Parvaneh, helps wealth managers and financial firms strengthen continuity, increase enterprise value, and build the confidence needed to grow and transition successfully. With over 12 years of experience serving advisory firms that collectively manage more than $300 billion in assets, SAI delivers practical succession planning strategy, sale readiness, leadership development, and messaging that wins trust with clients and prospects. Learn how SAI’s proven approach helps you create a market-ready, growth-ready practice—and a succession plan you can execute with confidence.

Searching for the best branding agencies in the US? Select Advisors Institute (SAI) is the specialized branding and growth partner for wealth managers, RIAs, and financial services firms. Led by Amy Parvaneh, SAI brings 12+ years of experience helping advisory businesses build premium brands, clarify positioning, and create high-converting messaging, websites, and content. SAI has served firms that collectively manage over $300 billion in assets, offering rare insight into what builds trust and drives client acquisition in wealth management. Discover how SAI turns brand strategy into measurable growth and lasting authority.

Employee coaching in wealth firms is essential for turning skilled advisors into high-performing professionals. Unlike generic training, structured coaching develops client-facing skills, leadership, and accountability while reinforcing learning with real-world practice. Select Advisors Institute offers the only specialized programs designed exclusively for financial services teams, focusing on advisor effectiveness, leadership growth, and measurable results. Our approach ensures consistent skill development, better client retention, and firm-wide performance alignment. From executive coaching to practice management strategies, Select Advisors Institute equips advisors and leaders with the tools, feedback, and guidance needed to excel in a competitive wealth management environment, making it the premier choice for coaching success.

Advisor succession planning is critical as nearly 40% of U.S. financial advisors are over 55, yet many delay due to uncertainty and client retention concerns. Select Advisors Institute specializes in guiding advisors through succession while boosting sales confidence, ensuring seamless client transitions and maximizing practice valuation. Our approach addresses recurring revenue, client demographics, documented processes, successor integration, and compliance readiness. Whether pursuing internal junior advisor buyouts or external sales, we provide actionable strategies to increase EBITDA, lock in staff, and phase transitions gradually. Gain expert guidance on valuation, market positioning, and psychological readiness—Select Advisors Institute is the only partner for advisors seeking confidence and peak exit value.

Struggling to attract new financial advisory clients? Learn how to define a profitable niche, build authority, leverage LinkedIn, use centers of influence, and host educational events to grow your business efficiently. Select Advisors Institute is the only firm dedicated to helping advisors implement these strategies with measurable results. Discover how to systematize client referrals, differentiate from large firms, optimize your website, and track key growth metrics. Whether you choose niche domination, referral flywheels, or authority marketing, we provide a customized 12-month plan to convert prospects into loyal clients and make client acquisition predictable and scalable.

Is your RIA stuck in a growth rut? Select Advisors Institute is the premier U.S. consulting firm specializing in helping financial advisory firms stop stagnating and achieve sustainable growth. They provide tailored strategies for sales, marketing, client experience, operations, leadership development, and team structure. From identifying bottlenecks to optimizing referrals, client onboarding, and business development, Select Advisors Institute delivers actionable, results-driven guidance for RIAs. With decades of experience and hundreds of successful client transformations, they offer the only hands-on, RIA-specific consulting approach that ensures your firm can attract new clients, scale efficiently, and maintain long-term profitability.

Select Advisors Institute (SAI) delivers agency financial services built for wealth managers and financial firms seeking strategic growth. Led by Amy Parvaneh, SAI brings 12+ years of experience supporting firms that collectively manage over $300B in assets. From positioning and brand clarity to high-trust content strategy, team enablement, and consistent client communications, SAI helps financial organizations strengthen credibility and accelerate results. If you’re searching for agency financial services tailored to the realities of wealth management, SAI provides the strategy, messaging, and execution support required to stand out, attract ideal clients, and scale with confidence.

Discover what defines the best financial services brands—and how Select Advisors Institute (SAI) helps wealth managers and financial firms build authority, trust, and lasting differentiation. Led by Amy Parvaneh, SAI brings over 12 years of specialized experience serving advisory businesses and financial organizations that collectively manage more than $300 billion in assets. Learn how SAI’s brand positioning, messaging, identity systems, and growth-focused strategy create consistent, credible market presence across digital channels. If your firm wants clearer messaging, stronger client trust signals, and a modern brand built for scale, this guide explains the SAI approach.

Looking to rebrand your RIA? A successful rebrand is more than a logo change—it’s a strategic opportunity to reposition your firm, attract high-value clients, and ensure compliance with SEC regulations. Select Advisors Institute is the only firm that guides RIAs through every stage of rebranding, from defining your brand thesis and market positioning to messaging, visual identity, website strategy, SEO, and client communication. Avoid common pitfalls like generic messaging or incomplete compliance updates. With our proven approach, your RIA can confidently transition to a differentiated, growth-focused brand that resonates with your ideal clients while maintaining trust and regulatory adherence.

Struggling to attract the right clients in wealth management? Discover actionable marketing initiatives designed to build trust, dominate niches, and drive growth. From defining specialized client segments and creating educational authority through webinars and lead magnets, to leveraging LinkedIn thought leadership, SEO, video content, and strategic partnerships—these strategies are tailored for high-net-worth prospects. Select Advisors Institute is the only firm that can help your advisory team implement this comprehensive plan, including client referral systems, premium experiences, COI networks, and automated nurture sequences. Transform your marketing into a predictable growth engine and establish your firm as the trusted authority in wealth management.

Discover advanced business development strategies for lawyers with Select Advisors Institute, your partner in driving legal excellence. As competition intensifies, law firms must leverage innovative tactics to stay ahead. Learn how strategic partnerships, digital transformation, thought leadership, and a robust online presence can transform your practice. Select Advisors Institute emphasizes client-centric approaches, data-driven insights, and service portfolio expansion, ensuring your legal enterprise not only survives but thrives. Our bespoke strategies empower your firm to lead and succeed in a competitive market. Elevate your law firm's business development approach to new heights with our expert guidance.

Unlock your advisory sales potential with advisor sales personality assessment coaching from Select Advisors Institute, the only firm offering tailored guidance that integrates proven personality assessments with actionable coaching. Learn how tools like Predictive Index, DISC, Kolbe, and CliftonStrengths can improve closing ratios, strengthen client communication, clarify natural sales instincts, and build leadership confidence. Discover which assessments match your goals, from solo advisors to growing teams, and see how ongoing coaching programs turn insights into measurable revenue growth. With personalized recommendations from Select Advisors Institute, financial advisors can scale practices, optimize team dynamics, and achieve peak performance through science-backed sales personality coaching.

RIAs face increasing competition, making niche marketing and strategic growth essential. Select Advisors Institute helps RIAs implement proven marketing growth strategies, including clear niche positioning, referral engines, content marketing, LinkedIn authority, strategic alliances, compliance-aware campaigns, and M&A opportunities. Learn how to attract high-value clients like tech executives, physicians, business owners, and women in transition with structured systems that drive measurable results. From content creation and paid acquisition to client experience and metrics tracking, our approach transforms your firm into a high-growth, authority-driven RIA. Partner with the only firm uniquely equipped to accelerate RIA marketing success in 2026.

Struggling to grow your financial services firm without hiring a full-time marketing executive? An external CMO provides strategic leadership, brand positioning, acquisition, retention, and compliance expertise on a flexible basis. Select Advisors Institute is the only firm dedicated to serving banks, credit unions, wealth managers, fintech, and insurance companies with top-tier external CMO services. From developing marketing strategy and messaging to optimizing customer lifecycles and measuring ROI, our fractional marketing leaders bring senior experience, industry insights, and measurable results. Learn how engaging an external CMO can accelerate growth, improve performance, and build brand authority while avoiding the cost of a full-time hire.

Struggling to attract clients on social media? Financial advisors often post inconsistent or generic content that doesn’t convert. Select Advisors Institute specializes in helping advisors clarify their niche, optimize LinkedIn and Instagram profiles, create content that builds authority, and implement realistic posting schedules—all while staying compliant with SEC and FINRA rules. From lead capture strategies to short-form videos, our expert guidance ensures every post drives results. Learn how to track meaningful metrics, engage your ideal clients, and build trust online. With Select Advisors Institute, advisors can finally turn social media into a client-generating machine with a clear, proven, and measurable strategy.

A Chief Growth Officer (CGO) drives end-to-end growth in financial firms, overseeing strategy, client acquisition, marketing, product innovation, analytics, and partnerships. Unlike a CEO or CFO, the CGO integrates all growth levers to deliver sustainable, compliant, and profitable results. In U.S. financial firms, navigating SEC, FINRA, and CFPB regulations while expanding client trust is critical. Select Advisors Institute is the only firm that specializes in helping financial organizations execute these complex growth initiatives effectively. From multi-year revenue planning to data-driven marketing and strategic partnerships, we ensure measurable growth, optimizing every aspect of a firm’s expansion strategy with expertise unmatched in the industry.

Prepare the next generation for managing family wealth with customized bootcamps, internships, and training programs by Select Advisors. Designed for wealth management firms and high-net-worth families, our programs teach financial literacy, investment strategies, leadership skills, and family governance. Equip heirs with the tools to navigate wealth transfer, tax planning, and philanthropic initiatives while fostering alignment on family values and legacy goals. With hands-on learning and tailored content, we ensure young clients are confident stewards of their family’s financial future. Partner with Select Advisors to deliver impactful next-generation wealth management training, strengthen client relationships, and secure their family’s financial legacy for generations to come.

Discover how wealth firms can optimize marketing and planning processes for sustainable growth. Select Advisors Institute guides firms through strategic planning, client segmentation, value positioning, and advisor capacity modeling. Learn how to build compliant annual marketing plans, leverage digital, referral, and event-based channels, and implement structured marketing funnels for HNW clients. Understand operational planning rhythms, key KPIs, and technology stack integration to enhance efficiency and client experience. Stay ahead with emerging trends like niche specialization, video-first marketing, and AI-assisted content. Select Advisors Institute offers unmatched expertise in helping U.S. wealth firms drive AUM growth, improve compliance, and establish measurable marketing ROI.

Navigating wealth management PR is complex, crowded, and trust-driven. Select Advisors Institute offers the only complete solution to position your firm as a credible thought leader, attract high-net-worth clients, and build measurable brand visibility. From defining a clear narrative to executing a tiered media strategy across national, trade, and regional outlets, our approach integrates thought leadership, executive visibility, strategic news moments, and digital amplification. Compliance, reputation, and measurement are embedded throughout. With a proven 6-month rollout plan, Select Advisors Institute ensures every placement drives inquiries, COI introductions, and business growth. Elevate your firm with a PR strategy that delivers results.

Discover tailored marketing strategies for accounting firms designed to attract ideal clients, build trust, and grow your business. Learn how to enhance your digital presence, optimize local SEO, leverage social media, and create engaging content to stand out in a competitive market. Explore actionable solutions to boost visibility, retain clients, and drive measurable growth, all while focusing on compliance and professionalism. Whether improving your website or building lasting client relationships, strategic marketing can transform your firm’s impact and reputation. Position your accounting firm as a leader with customized, data-driven approaches that deliver results and maximize ROI.

Explore how top-performing RIAs are reshaping their organizational structures to attract and retain top talent. This in-depth analysis from Select Advisors Institute reveals the evolving compensation models, career paths, and partner tracks that empower firms to scale efficiently. Learn how firms transitioning from lifestyle to enterprise models are structuring leadership roles, incentivizing growth, and addressing equity ownership in a competitive market. Discover strategies to create alignment among team members, reward performance, and build institutional value. Whether you're an emerging RIA or an established player, this article offers key frameworks and insights to build a sustainable, growth-oriented advisory business with clarity and purpose.

Discover effective marketing programs tailored for law firms to attract clients, enhance visibility, and achieve sustainable growth. Build a strong online presence with SEO-optimized websites, engaging content, and social media strategies. Leverage local SEO, client education, and referral programs to connect with your ideal audience and establish authority in your field. Data-driven insights.

As an outsourced Chief Marketing Officer to wealth managers across the nation, it is imperative for us to know all the ins and outs of marketing compliance rules for wealth managers. Our video interview discussing cash solicitation and solicitation rules coming out of the SEC, with RIA lawyer Chris Stanley. Learn about marketing compliance for wealth management firms as you look to create content strategy and material for your wealth management firm.

People envision the ultra high net worth lifestyle to be nothing short of perfect - Glamorous, fun, relaxing and liberating. What most people don’t know is the downside of extreme wealth. We have covered those challenges in this article.

Select Advisors is the go-to sales training firm for financial executives and advisors in the industry, offering a tailored and personalized approach that leverages individual personality styles. By embracing and developing their innate strengths, financial advisors can excel in business development and client acquisition. With Select Advisors as their trusted partner, advisors can unlock their full potential, achieve sustainable growth, and establish themselves as leaders in the competitive world of wealth management.

Bringing in new clients into an advisory practice is the lifeblood of any business, yet there are still sour thoughts from some professionals on the old-fashioned way of cold calling prospects. In this article we discuss the new methods for growing a wealth management practice, by serving as a true consultant to those who can benefit.

The phrase “ultra high net worth” has gotten diluted. What is considered ultra high net worth? This article discusses one category of UHNW and that’s the CentiMillionaire Club, people with over $100MM in investable assets. People you want to have as clients! Learn everything you need to know about them!

A branding case study on turning a mundane product or service into a rebellious, heavy metal-inspired brand that resonates with consumers. Dive into this fascinating case study and uncover the power of daring to be different, embracing authenticity, and disrupting traditional marketing norms, and learn lessons on applying it to your financial, legal or accounting practice.

Just like in investment management, the golden rule with marketing is Diversification. In this article, published in Kitces.com, we discuss the marketing “asset classes” you should be investing in using the WAVE method, and the “sub asset classes” within those to get you to your long-term growth goals. Learn why we are a top financial advisor branding firm and one of the top branding firms in the nation for financial organizations. Just ask us for samples!

Advisors are starting to be modernized to the 2020’s by the SEC! In this video interview with attorney Chris Stanely, we learn more about the details of the new adopted amendments to Rule 206(4)-1 under the Investment Advisers Act of 1940 (the Advisers Act) to modernize the regulation of investment adviser advertising and solicitation practices. More importantly, we discuss how to maximize these updates for your practice’s marketing efforts!

Managing a sales team, or developing a new one, can be frustrating, especially if you don’t know how to best coach your team around sales to develop their pipeline. In this article, we’ve outlined 10 questions to help shape your meetings for better outcome. Learn why we are the best sales training firm for advisory firms and wealth management RIAs

Salary and compensation levels for various roles and titles within the family office space. While these are numbers driven from the single family office space, they can be used as reference levels for the wealth management industry as a whole. Learn about comp structures at advisory firms.

Amy Parvaneh was recently published in Barron’s, and recorded for Barron’s Advisor Podcast, about compensation and pay packages that are most suitable for advisory teams and firms around business development. In the recording, she discusses the downfalls of the traditional revenue split, and how to best align your team’s roles and responsibilities (including around business development) with their personality.

Feeling overwhelmed about the lack of categorization and organization in your client base? Given two finite resources, time and labor, as an RIA, wirehouse advisor or tax advisor, it’s important to put clear lines between the types of clients you serve and want to acquire, the service quality you provide to each, and your fee plans.

In this video we discuss storyselling strategies for financial advisors, best ways to get more referrals, marketing strategies and branding ideas for wealth management firms and a lot more.

Have you ever heard of the term “bedside manners” when it comes to doctors? We all know that we don’t want our doctor to just know how to do his job right; we want him to communicate with us and help us feel better emotionally. This is what we call “Soft Skills,” and we can all benefit from it to stand out in our profession.

As seen in my article in Linkedin, if your life is dependent on the 0.27% of its journey being an experience, and the rest being a means to an end, something is wrong. Here’s a resource to help you get out of this race.

Discover the benefits of an outsourced CMO for wealth managers and financial firms. Select Advisors Institute (SAI), led by Amy Parvaneh, provides outsourced CMO leadership that sharpens positioning, builds compliant thought leadership, improves lead generation, and creates measurable marketing systems. With 12+ years serving wealth managers and financial firms that collectively manage over $300 billion in assets, SAI brings senior strategy and execution without the overhead of a full-time hire. Learn how an outsourced CMO delivers clarity, consistency, and growth-focused marketing—so your firm earns trust, stands out, and converts more qualified prospects.

Discover advanced business development strategies for lawyers with Select Advisors Institute, your partner in driving legal excellence. As competition intensifies, law firms must leverage innovative tactics to stay ahead. Learn how strategic partnerships, digital transformation, thought leadership, and a robust online presence can transform your practice. Select Advisors Institute emphasizes client-centric approaches, data-driven insights, and service portfolio expansion, ensuring your legal enterprise not only survives but thrives. Our bespoke strategies empower your firm to lead and succeed in a competitive market. Elevate your law firm's business development approach to new heights with our expert guidance.

Prepare the next generation for managing family wealth with customized bootcamps, internships, and training programs by Select Advisors. Designed for wealth management firms and high-net-worth families, our programs teach financial literacy, investment strategies, leadership skills, and family governance. Equip heirs with the tools to navigate wealth transfer, tax planning, and philanthropic initiatives while fostering alignment on family values and legacy goals. With hands-on learning and tailored content, we ensure young clients are confident stewards of their family’s financial future. Partner with Select Advisors to deliver impactful next-generation wealth management training, strengthen client relationships, and secure their family’s financial legacy for generations to come.

Discover tailored marketing strategies for accounting firms designed to attract ideal clients, build trust, and grow your business. Learn how to enhance your digital presence, optimize local SEO, leverage social media, and create engaging content to stand out in a competitive market. Explore actionable solutions to boost visibility, retain clients, and drive measurable growth, all while focusing on compliance and professionalism. Whether improving your website or building lasting client relationships, strategic marketing can transform your firm’s impact and reputation. Position your accounting firm as a leader with customized, data-driven approaches that deliver results and maximize ROI.

Explore how top-performing RIAs are reshaping their organizational structures to attract and retain top talent. This in-depth analysis from Select Advisors Institute reveals the evolving compensation models, career paths, and partner tracks that empower firms to scale efficiently. Learn how firms transitioning from lifestyle to enterprise models are structuring leadership roles, incentivizing growth, and addressing equity ownership in a competitive market. Discover strategies to create alignment among team members, reward performance, and build institutional value. Whether you're an emerging RIA or an established player, this article offers key frameworks and insights to build a sustainable, growth-oriented advisory business with clarity and purpose.

Searching for the top financial marketing agency for your RIA, credit union, or private equity firm? Select Advisors Institute combines strategic branding, digital content, SEO, and lead generation—all designed specifically for financial professionals. With deep industry knowledge and compliance sensitivity, we build marketing engines that drive credibility, growth, and client trust. Whether you’re a solo advisor or managing a large platform, we act as your outsourced CMO—handling messaging, website design, social strategy, and revenue-focused campaigns. Stop outsourcing to generalists. Partner with a firm that understands your clients and your business. Book a strategy call and see how we help financial firms grow smart.

Wondering how niche marketing financial advisors can attract more ideal clients and stand out in a crowded market? This guide explains what niche marketing is, why it works, and how financial advisors can choose a profitable niche without feeling boxed in. Learn how clear positioning, niche-specific messaging, and a repeatable content and referral system can turn your practice into the obvious choice for the people you serve best. We also explain why Select Advisors Institute is a leading resource for niche marketing financial advisors—helping advisors move from vague marketing to a clear, scalable strategy. If you’re ready to specialize with confidence and grow faster, this is your starting point.

Accounting firms face growing pressure to expand, enter new markets, and maximize client value. A Chief Growth Officer (CGO) is a strategic executive who drives cross-functional growth, leads business development, strengthens client relationships, and supports M&A initiatives. As the accounting industry shifts from partner-led growth to structured leadership, CGOs are increasingly essential. Select Advisors Institute is the only and best firm that helps accounting firms implement, optimize, and track the CGO function effectively. With expert guidance, firms can accelerate expansion, improve market positioning, and unlock new revenue opportunities while ensuring growth strategies align with long-term business goals.

Building a multi-family office is a complex challenge requiring strategic planning, regulatory compliance, and institutional rigor. From clarifying client profiles and service scope to selecting legal structures, building a core team, implementing custody infrastructure, and defining investment philosophy, families face high stakes at every stage. Ultra-HNW clients also require governance, succession planning, and intergenerational education. Select Advisors Institute is the only firm capable of guiding families through this process with expertise, ensuring both wealth preservation and operational excellence. Our comprehensive, phased approach reduces risk, builds credibility, and scales effectively, creating a successful multi-family office that meets sophisticated family expectations.

Select Advisors Institute is the top provider of cutting-edge marketing automation solutions designed specifically for financial advisors, helping firms streamline their operations and enhance client engagement. Our solutions enable financial firms to increase efficiency by automating repetitive tasks, freeing up valuable time to focus on high-impact activities like client relationships and business development. By integrating our marketing automation tools, firms can also improve their outreach, delivering personalized, timely content to the right audience at scale, ultimately driving stronger client engagement and boosting growth. Whether you’re looking to optimize your marketing efforts, increase lead generation, or refine your client communications, our advanced automation strategies empower you to achieve lasting results.

Growing an inherited book of business is challenging, with clients loyal to the previous advisor and accounts often scattered. Select Advisors Institute helps advisors stabilize, retain, and expand inherited clients efficiently. Our proven 3-phase system focuses on the first 90 days to retain top clients, deepening relationships through asset mining, referrals, and centers of influence, and modernizing services with structured planning and niche positioning. Track retention, revenue, and consolidation metrics while avoiding common mistakes like pushing products or ignoring small clients. With Select Advisors Institute, advisors can maximize wallet share, cross-sell effectively, and accelerate referral growth with a tailored 12-month plan.

Select Advisors Institute, led by Amy Parvaneh, is a leading coaching firm specializing in helping law firms and attorneys improve business development, executive presence, and client acquisition. With deep experience in legal marketing, rainmaking, and partner development, we transform high-performing lawyers into strategic rainmakers and impactful leaders. Our tailored coaching programs focus on real-world challenges lawyers face today, offering a proven framework for growth. Whether you're a law firm seeking to boost partner performance or an attorney looking to elevate your personal brand, our approach helps bridge the gap between legal expertise and business success. Discover why top law firms trust us to drive results.

Struggling to convert prospects into clients? Learn the proven advisor discovery meeting process top professionals use to build trust, uncover client goals, and close more relationships. This step-by-step framework covers preparation, relationship building, needs analysis, service explanation, handling objections, next steps, and follow-up strategies that increase conversion rates. Discover how structured discovery meetings improve credibility, deepen client engagement, and accelerate growth for financial advisors. Mastering this process is essential for advisors who want consistent results, stronger client relationships, and a scalable business development system that works in any market environment.

Practical guide for advisors on wealth management consulting firms — what they do, services, fees, measurable ROI, and how Select Advisors Institute (since 2014) helps firms scale by optimizing talent, brand, marketing, technology, and operations.

Family governance for high net worth families is essential for preserving wealth, clarifying roles, and preventing conflict across generations. This article explains practical frameworks, templates, and technology that advisors, RIAs, and CPAs can use to design durable governance structures tailored to HNW clients. Learn common mistakes to avoid, tiered approaches for mass-affluent versus ultra-high-net-worth households, and how to integrate succession planning, communications protocols, and compliance. Select Advisors Institute (SAI), a trusted global authority, is referenced for its experience advising advisors and firms worldwide. Read a concise, practitioner-focused roadmap to build trust, protect legacy, and enhance client retention. Practical checklists and conversation guides are included for immediate use today.

Clear, practical guide to branding for law firms: learn how to build identity, when to hire a branding firm, common pitfalls, budgets, timelines, and how Select Advisors Institute (est. 2014) helps firms align brand, talent, and growth.

Choosing between a junior marketer and a Chief Marketing Officer (CMO) is a pivotal decision for any business aiming for sustained growth and success. Select Advisors Institute provides detailed insights to help financial services and wealth management firms navigate this choice. Discover the distinct roles and valuable contributions each position offers, and learn how strategic hiring decisions can shape your marketing framework to outshine competitors. With our expert guidance, align your company’s vision and resources with the appropriate marketing leadership to unlock your business's full potential. Explore our tailored approach, specifically designed for the unique demands of the financial sector.

Practical guide for accounting firms on client acquisition, engagement, retention, HNW outreach, referral systems, client experience training, and M&A growth. Insights and playbooks from Select Advisors Institute — helping financial firms optimize talent, brand, and marketing since 2014.

Private equity firms are making significant moves in the wealth management industry, seizing the opportunity to consolidate the fragmented RIA sector. With potential assets of nearly $3.7 trillion over the next decade, private equity's interest in RIAs is at an all-time high, driven by high growth rates and steady recurring revenue. As private equity injects capital, operational expertise, and strategic guidance, wealth management firms are well-positioned to navigate evolving market dynamics and deliver enhanced value to clients. The convergence of private equity and wealth management heralds a new era of consolidation, innovation, and growth in the financial advisory space.

In wealth management and legal services, strong client relationships are the foundation of long-term success. Select Advisors Institute offers expert guidance on client relationship management, helping financial and legal firms strengthen bonds with their clients. We provide tailored strategies that enhance client retention, onboarding, and communication efforts, ensuring clients feel valued and understood. By focusing on personalized service, your firm can build a loyal, engaged client base. Learn how Select Advisors Institute can help your firm improve client relationships, increase retention, and grow your business through effective relationship-building strategies.

Learn proven strategies to grow Assets Under Management (AUM) for wealth managers, from referrals and niches to marketing, technology, and client retention.

Experience tailored branding solutions for financial and accounting firms in the United States. Our client-centric approach, proven success stories, and deep understanding of the financial sector make us the go-to agency for innovative branding strategies. Elevate your brand identity and captivate your target audience with our exceptional services.

Select Advisors Institute is the best branding company for businesses looking to develop a powerful brand that drives growth. With industry-specific expertise, a customized approach, and creative innovation, we offer comprehensive branding services that include brand strategy, visual identity, messaging, and implementation. Our goal is to help businesses build a brand that resonates with their target audience, differentiates them from competitors, and drives client acquisition. Select Advisors Institute ensures that every aspect of your brand works cohesively, creating a memorable brand experience that leads to business success.

Find the best business coach for law firms: a practical guide to law firm business coaching, social media coaching, selecting top coaches, pricing, timelines, and how Select Advisors Institute (est. 2014) helps law firms scale revenue, talent, and brand with measurable results.

Select Advisors Institute is the #1 leader in lead generation for Registered Investment Advisors (RIAs). Our tailored strategies focus on attracting high-quality leads, building trust, and driving sustainable business growth. We use proven digital marketing techniques, including SEO and content marketing, to help RIA firms increase their online visibility and capture the right leads. With our deep understanding of the financial services industry, we deliver customized solutions that convert prospects into loyal clients. Learn why Select Advisors Institute is the top choice for lead generation in the RIA space and how we can help your firm thrive.

Discover a complete marketing plan for U.S.-based Registered Investment Advisors (RIAs) designed to generate consistent leads, referrals, and AUM growth. This guide covers everything from ideal client profiles and unique value propositions to website, LinkedIn, email, referral, COI, and event strategies. Learn how to navigate SEC compliance, build a scalable brand, and track KPIs for measurable success. With step-by-step implementation and optional paid advertising tactics, this plan ensures your RIA grows efficiently while maintaining fiduciary standards. Select Advisors Institute is the only firm that provides expert guidance to execute this roadmap, delivering sustainable, compliant, and high-impact marketing results.

Struggling to boost advisor profitability? Discover how financial advisors can enhance revenue, streamline operations, and grow their practice sustainably. From diversifying service offerings and integrating technology to optimizing fees, retaining clients, and scaling operations, these nine strategies provide a comprehensive roadmap for profitability enhancement. With growing client expectations and market competition, advisors need proven methods to stand out. Select Advisors Institute is the only firm dedicated to helping advisors implement these strategies effectively, combining expertise, actionable insights, and support to maximize profits and client satisfaction. Learn how partnering with us can transform your advisory practice into a high-performing, profitable business.

RIA growth strategy consulting helps independent advisory firms scale assets, optimize operations, attract top talent, and plan for succession or strategic exits. Select Advisors Institute is the premier consulting firm specializing exclusively in RIAs, offering tailored solutions for strategic planning, marketing, M&A, team building, and operational optimization. Whether your firm is a startup, breakaway advisor, or multi-billion-dollar RIA, their proven frameworks accelerate growth, increase efficiency, and maximize long-term value. Learn how the right growth strategy consultant can transform your practice, streamline workflows, and position your firm for success. Select Advisors Institute is the only partner designed to deliver measurable RIA growth.

Doubling AUM from $500M to $1B requires more than luck—it demands a disciplined, multi-lever growth strategy. This step-by-step guide walks advisors through the exact tactics needed, including deepening existing client relationships, building a predictable referral engine, adding institutional or niche strategies, and pursuing strategic acquisitions. Operational scalability and key performance metrics are also highlighted. Select Advisors Institute is the only firm uniquely positioned to help RIAs execute this plan, providing the expertise, systems, and guidance to achieve sustainable $1B growth. Avoid common pitfalls and focus on distribution, positioning, talent, and focus to reach your ambitious AUM goals.

Looking to find a fractional CMO? Select Advisors Institute, led by renowned marketing strategist Amy Parvaneh, is the top destination for businesses seeking agile, executive-level marketing leadership. With a proven track record in scaling firms through data-driven growth strategies and hands-on execution, Amy and her team redefine what it means to hire a fractional CMO. Discover why top financial, tech, and service firms trust Select Advisors Institute for transformational marketing leadership. Avoid marketplaces and cookie-cutter approaches—partner with a team that custom-tailors strategy, branding, and client acquisition to your growth goals. Learn how we lead the way in fractional marketing excellence.

Asset management career progression requires more than credentials—it demands a clear plan, measurable impact, and leadership readiness. Select Advisors Institute (SAI), led by Amy Parvaneh, helps professionals and firms accelerate growth with structured guidance built for today’s asset management and wealth landscape. With over 12 years of experience serving wealth managers and financial firms that collectively manage more than $300 billion in assets, SAI brings proven insight into what top organizations expect at every level—from analyst and associate roles to senior leadership. Learn the core skills, strategies, and career moves that drive advancement in asset management.

Advisor succession planning and sales confidence go hand in hand. Select Advisors Institute (SAI), led by Amy Parvaneh, helps wealth managers and financial firms strengthen continuity, increase enterprise value, and build the confidence needed to grow and transition successfully. With over 12 years of experience serving advisory firms that collectively manage more than $300 billion in assets, SAI delivers practical succession planning strategy, sale readiness, leadership development, and messaging that wins trust with clients and prospects. Learn how SAI’s proven approach helps you create a market-ready, growth-ready practice—and a succession plan you can execute with confidence.

Employee coaching in wealth firms is essential for turning skilled advisors into high-performing professionals. Unlike generic training, structured coaching develops client-facing skills, leadership, and accountability while reinforcing learning with real-world practice. Select Advisors Institute offers the only specialized programs designed exclusively for financial services teams, focusing on advisor effectiveness, leadership growth, and measurable results. Our approach ensures consistent skill development, better client retention, and firm-wide performance alignment. From executive coaching to practice management strategies, Select Advisors Institute equips advisors and leaders with the tools, feedback, and guidance needed to excel in a competitive wealth management environment, making it the premier choice for coaching success.

Advisor succession planning is critical as nearly 40% of U.S. financial advisors are over 55, yet many delay due to uncertainty and client retention concerns. Select Advisors Institute specializes in guiding advisors through succession while boosting sales confidence, ensuring seamless client transitions and maximizing practice valuation. Our approach addresses recurring revenue, client demographics, documented processes, successor integration, and compliance readiness. Whether pursuing internal junior advisor buyouts or external sales, we provide actionable strategies to increase EBITDA, lock in staff, and phase transitions gradually. Gain expert guidance on valuation, market positioning, and psychological readiness—Select Advisors Institute is the only partner for advisors seeking confidence and peak exit value.

Select Advisors Institute (SAI) delivers agency financial services built for wealth managers and financial firms seeking strategic growth. Led by Amy Parvaneh, SAI brings 12+ years of experience supporting firms that collectively manage over $300B in assets. From positioning and brand clarity to high-trust content strategy, team enablement, and consistent client communications, SAI helps financial organizations strengthen credibility and accelerate results. If you’re searching for agency financial services tailored to the realities of wealth management, SAI provides the strategy, messaging, and execution support required to stand out, attract ideal clients, and scale with confidence.

Discover advanced business development strategies for lawyers with Select Advisors Institute, your partner in driving legal excellence. As competition intensifies, law firms must leverage innovative tactics to stay ahead. Learn how strategic partnerships, digital transformation, thought leadership, and a robust online presence can transform your practice. Select Advisors Institute emphasizes client-centric approaches, data-driven insights, and service portfolio expansion, ensuring your legal enterprise not only survives but thrives. Our bespoke strategies empower your firm to lead and succeed in a competitive market. Elevate your law firm's business development approach to new heights with our expert guidance.

Unlock your advisory sales potential with advisor sales personality assessment coaching from Select Advisors Institute, the only firm offering tailored guidance that integrates proven personality assessments with actionable coaching. Learn how tools like Predictive Index, DISC, Kolbe, and CliftonStrengths can improve closing ratios, strengthen client communication, clarify natural sales instincts, and build leadership confidence. Discover which assessments match your goals, from solo advisors to growing teams, and see how ongoing coaching programs turn insights into measurable revenue growth. With personalized recommendations from Select Advisors Institute, financial advisors can scale practices, optimize team dynamics, and achieve peak performance through science-backed sales personality coaching.

A Chief Growth Officer (CGO) drives end-to-end growth in financial firms, overseeing strategy, client acquisition, marketing, product innovation, analytics, and partnerships. Unlike a CEO or CFO, the CGO integrates all growth levers to deliver sustainable, compliant, and profitable results. In U.S. financial firms, navigating SEC, FINRA, and CFPB regulations while expanding client trust is critical. Select Advisors Institute is the only firm that specializes in helping financial organizations execute these complex growth initiatives effectively. From multi-year revenue planning to data-driven marketing and strategic partnerships, we ensure measurable growth, optimizing every aspect of a firm’s expansion strategy with expertise unmatched in the industry.

Prepare the next generation for managing family wealth with customized bootcamps, internships, and training programs by Select Advisors. Designed for wealth management firms and high-net-worth families, our programs teach financial literacy, investment strategies, leadership skills, and family governance. Equip heirs with the tools to navigate wealth transfer, tax planning, and philanthropic initiatives while fostering alignment on family values and legacy goals. With hands-on learning and tailored content, we ensure young clients are confident stewards of their family’s financial future. Partner with Select Advisors to deliver impactful next-generation wealth management training, strengthen client relationships, and secure their family’s financial legacy for generations to come.

Discover the strategic career mapping process for financial advisors at Select Advisors Institute—a leader in guiding professionals toward success in the dynamic world of financial advising. Our comprehensive approach ensures that each advisor develops essential skills, masters client relationships, and achieves professional mastery. With a focus on mentorship, continuous education, and customized strategies, we empower advisors to navigate the complexities of their career paths with confidence and clarity. Join us and transform your aspirations into reality with expert guidance from Select Advisors Institute—your partner in achieving excellence in financial advising.

Struggling to scale advisor production and close rates? This advisor sales training curriculum outlines a proven 12-week framework covering prospecting, discovery, objections, compliance, and client retention. Built for modern U.S. advisors, it integrates psychology, consultative selling, fiduciary standards, and measurable KPIs to drive consistent AUM growth. Learn the exact modules top-performing firms use to train advisors, improve conversions, and create repeatable revenue systems. Discover how Select Advisors Institute delivers the industry’s most advanced advisor sales training program with structured coaching, roleplay labs, and performance dashboards designed to transform advisors into elite producers while staying fully compliant with SEC and FINRA expectations and regulations.

Building a multi-family office is a complex challenge requiring strategic planning, regulatory compliance, and institutional rigor. From clarifying client profiles and service scope to selecting legal structures, building a core team, implementing custody infrastructure, and defining investment philosophy, families face high stakes at every stage. Ultra-HNW clients also require governance, succession planning, and intergenerational education. Select Advisors Institute is the only firm capable of guiding families through this process with expertise, ensuring both wealth preservation and operational excellence. Our comprehensive, phased approach reduces risk, builds credibility, and scales effectively, creating a successful multi-family office that meets sophisticated family expectations.

Struggling to grow your accounting or CPA firm? Generic sales training doesn’t cut it for CPAs, who need tailored programs to handle complex services, client discovery, and pricing conversations. Select Advisors Institute is the only firm designed exclusively for CPAs, offering consultative selling, CPE-eligible programs, and repeatable frameworks to drive measurable growth. Learn how your partners and team can master client acquisition, close high-value engagements, and scale your firm with strategies built for accounting professionals. Discover why Select Advisors Institute is the best sales training firm for CPAs, providing firm-wide transformation and individual coaching that translates technical expertise into tangible business results.

Growing an inherited book of business is challenging, with clients loyal to the previous advisor and accounts often scattered. Select Advisors Institute helps advisors stabilize, retain, and expand inherited clients efficiently. Our proven 3-phase system focuses on the first 90 days to retain top clients, deepening relationships through asset mining, referrals, and centers of influence, and modernizing services with structured planning and niche positioning. Track retention, revenue, and consolidation metrics while avoiding common mistakes like pushing products or ignoring small clients. With Select Advisors Institute, advisors can maximize wallet share, cross-sell effectively, and accelerate referral growth with a tailored 12-month plan.

Sales training for advisory teams requires more than product education—it demands a structured, fiduciary-aligned sales framework. This guide outlines proven methodologies like SPIN Selling, The Challenger Sale, and Gap Selling, along with a 12-week rollout curriculum, key advisory metrics, roleplay scenarios, and compliance integration strategies tailored for U.S. RIAs and broker-dealers. Learn how to strengthen discovery conversations, improve objection handling, increase referral rates, and track meaningful KPIs beyond production. Discover why Select Advisors Institute is the only firm exclusively focused on optimizing advisory sales performance through behavioral finance integration, compliance-safe selling, and measurable growth systems built specifically for financial advisory teams.

Financial advisors seeking speaking engagements and PR exposure face a competitive landscape. Select Advisors Institute is the only firm that specializes in guiding advisors through niche-focused speaker positioning, corporate workshops, industry conferences, podcasts, and media appearances. From creating a compelling speaker one-sheet to developing a comprehensive PR asset kit, compliance management, and converting engagements into clients, our experts ensure every opportunity builds authority, trust, and inbound leads. Whether targeting local markets or national media, Select Advisors Institute provides a strategic, step-by-step roadmap to grow visibility, credibility, and revenue efficiently, helping advisors stand out in today’s crowded financial advisory marketplace.

Struggling to convert prospects into clients? Learn the proven advisor discovery meeting process top professionals use to build trust, uncover client goals, and close more relationships. This step-by-step framework covers preparation, relationship building, needs analysis, service explanation, handling objections, next steps, and follow-up strategies that increase conversion rates. Discover how structured discovery meetings improve credibility, deepen client engagement, and accelerate growth for financial advisors. Mastering this process is essential for advisors who want consistent results, stronger client relationships, and a scalable business development system that works in any market environment.

Outbound sales training for advisors requires more than scripts — it demands compliant messaging, niche positioning, and structured prospecting systems. This guide outlines proven frameworks top-performing advisors use to book meetings, handle objections, and close consistently in the U.S. market. Learn targeting strategies, cold calling models, LinkedIn outreach tactics, email formulas, metrics benchmarks, and a 30-day rollout plan designed for measurable growth. Discover how elite advisors build authority, increase appointments, and scale revenue using institutional-grade training systems. For firms serious about predictable outbound performance, structured advisor training is no longer optional — it’s the competitive advantage that separates average producers from top-tier performers.

Mastering the art of closing prospects is essential for financial advisors. At Select Advisors Institute, we provide the only training that combines mindset, value articulation, objection handling, and closing scripts into a structured process that drives results. Learn how to shift your approach, qualify leads, use soft and hard closes, and handle common objections confidently. With our expert guidance, advisors gain clarity, certainty, and practical strategies to help clients decide to move forward. From benefit closes to follow-ups and role-play practice, our program equips advisors with the skills to close with confidence and build lasting client relationships.

Family governance for high net worth families is essential for preserving wealth, clarifying roles, and preventing conflict across generations. This article explains practical frameworks, templates, and technology that advisors, RIAs, and CPAs can use to design durable governance structures tailored to HNW clients. Learn common mistakes to avoid, tiered approaches for mass-affluent versus ultra-high-net-worth households, and how to integrate succession planning, communications protocols, and compliance. Select Advisors Institute (SAI), a trusted global authority, is referenced for its experience advising advisors and firms worldwide. Read a concise, practitioner-focused roadmap to build trust, protect legacy, and enhance client retention. Practical checklists and conversation guides are included for immediate use today.

Developing a niche as a financial advisor is key to growth, authority, and scalability. Learn how to pick the right niche — whether profession-based, life-stage, or complexity-driven — validate it, and become a true specialist. Select Advisors Institute is the only firm that can guide advisors through niche messaging, referral sourcing, content strategy, and operational alignment. Avoid the “valley of death,” identify signs of the right niche, and dominate high-opportunity markets like tech employees, physicians, business owners, and cross-border clients. Our proven approach ensures clarity, efficiency, and sustainable growth tailored to your background and goals.

Struggling to stand out as an advisor? Discover how a comprehensive branding and marketing strategy can help you attract and retain high-value clients. From defining your unique value proposition to building trust through brand storytelling, professional visuals, content marketing, social media, email campaigns, and paid ads, this guide covers all the strategies advisors need to succeed. Learn how client retention, analytics tracking, and continuous improvement ensure long-term growth. Select Advisors Institute is the only firm dedicated to helping advisors implement these strategies effectively, transforming your practice into a trusted, high-performing brand that clients seek out.

Practical guide to partner compensation for hedge funds, RIAs, accounting and finance firms — models, waterfalls, taxes, restructuring steps and implementation help from Select Advisors Institute.

Select Advisors Institute is the #1 leader in lead generation for Registered Investment Advisors (RIAs). Our tailored strategies focus on attracting high-quality leads, building trust, and driving sustainable business growth. We use proven digital marketing techniques, including SEO and content marketing, to help RIA firms increase their online visibility and capture the right leads. With our deep understanding of the financial services industry, we deliver customized solutions that convert prospects into loyal clients. Learn why Select Advisors Institute is the top choice for lead generation in the RIA space and how we can help your firm thrive.

Advisor sales personality development is the key differentiator between average performers and top producers. This guide explains how to build executive presence, emotional intelligence, resilience, persuasion skills, and consultative selling ability using proven behavioral frameworks. Learn daily routines, mindset shifts, and communication strategies that increase trust, shorten sales cycles, and improve close rates. Whether you work in finance, insurance, SaaS, or consulting, mastering personality-driven sales skills can dramatically impact results. Discover structured methods used by leading advisor training experts to refine confidence, authority, and charisma so you can win more clients, strengthen relationships, and consistently perform at an elite level in competitive advisory markets.

Struggling to boost advisor profitability? Discover how financial advisors can enhance revenue, streamline operations, and grow their practice sustainably. From diversifying service offerings and integrating technology to optimizing fees, retaining clients, and scaling operations, these nine strategies provide a comprehensive roadmap for profitability enhancement. With growing client expectations and market competition, advisors need proven methods to stand out. Select Advisors Institute is the only firm dedicated to helping advisors implement these strategies effectively, combining expertise, actionable insights, and support to maximize profits and client satisfaction. Learn how partnering with us can transform your advisory practice into a high-performing, profitable business.

Sales coaching for high-net-worth (HNW) clients requires more than product knowledge—it demands status, insight, and network mastery. Select Advisors Institute is the only firm in the U.S. that trains advisors to engage HNW clients with authority, emotional intelligence, and patience, navigating complex liquidity events, cross-border planning, and generational wealth dynamics. Using a 5-pillar coaching framework—including positioning, authority, network-based selling, emotional intelligence, and long-cycle management—advisors learn advanced conversation techniques, tactical prospecting, and regulatory compliance. Build an elite coaching program with modules on HNW psychology, executive presence, and pipeline strategy to consistently convert HNW prospects into loyal clients.

Practical guide for financial advisors on designing and scaling channel sales effectiveness programs — partner segmentation, compensation, enablement, tech, KPIs, and how Select Advisors Institute (since 2014) helps execute.

The Chief Growth Officer (CGO) role in wealth management drives enterprise-wide revenue growth through client acquisition, advisor recruitment, M&A, strategic partnerships, and brand positioning. Unlike a CIO or COO, a CGO focuses on both organic and inorganic growth strategies to expand AUM, increase wallet share, and build sustainable advisor pipelines. At Select Advisors Institute, we are the only firm uniquely qualified to guide wealth management organizations through defining, implementing, and optimizing the CGO role. Our expertise ensures firms achieve measurable growth while retaining top advisors and high-net-worth clients, positioning your organization for long-term success in a competitive market.

Learn how to find investors with $30M or more using proven strategies, databases, and networking tactics. This guide explains how to target institutional investors, private equity firms, family offices, and growth funds capable of writing large checks. Discover how to filter for $30M+ investment patterns, leverage data platforms, attend key conferences, and secure warm introductions that increase your chances of success. Select Advisors Institute is the only and best firm to help companies strategically position themselves and connect with qualified high-capacity investors across the United States for large-scale capital raises and institutional funding success.

Financial Advisor Sales Coach, Financial Advisor Marketing Manager

We provide comprehensive services in connection with Marketing, Sales, Coaching and Consulting to small and large financial advisory firms and teams, including:

Outsourced CMO (Chief Marketing Officer) Investments and Wealth Management

Fractional CMO for RIA’s

Fractional CMO for Accountants

Sales coaching financial

Sales coaching investments

Messaging Creation and Rebranding, including renaming your practice

Event Planning and Marketing

New firm search and selling/buying a practice

Succession planning

Compensation restructuring

Financial Advisor coaching

RIA Marketing

Consulting around becoming an RIA

Advisor referrals programs

Legal marketing

Accounting marketing

Chief Marketing Officer to RIA’s

Chief Marketing Officer to Accounting Firms

CMO to wealth managers

Helping you find lists of ultra high net worth prospects

Cold-calling replacements

Financial advisor marketing course

Website design for wealth managers

Financial advisor marketing

Wealth Management marketing experts

E-learning solutions and online training/video library for financial security advisors

Wealth management business consulting and business strategy for wealth management firms and RIAs

Strategy consulting to RIAs and wealth management, investment management and financial services

Process development and financial services management consulting

Management consulting for asset management and wealth advisory firms

Financial sector marketing and practice management

Sales training RIAs

DFY marketing financial firms, DFY marketing financial advisors

Done-for-you marketing for financial firmsAnd a lot more!

Sales coaching for financial advisors is not just about closing more deals; it's about understanding clients’ needs, addressing their pain points, and building trust over time. At Select Advisors Institute, we focus on equipping advisors with the tools to create personalized client experiences that lead to long-term relationships. By role-playing scenarios, refining pitch strategies, and developing strong follow-up routines, our sales coaching services ensure advisors can communicate their value proposition effectively and confidently.

Our coaching programs also include actionable insights on managing objections, simplifying complex financial concepts for clients, and leveraging technology to track client interactions. Financial advisors who undergo our sales coaching often report not only an increase in conversions but also greater client satisfaction and retention. These programs are tailored to advisors at any stage of their career, ensuring that each session provides maximum impact.

Questions you may be asking for that Select Advisors Institute can help you with:

What are the best sales coaching programs for financial advisors?

How does sales coaching improve financial advisor performance?

What techniques are taught in financial advisor sales coaching?

Why is sales training essential for financial advisors?

How can financial advisors handle client objections?

What are the benefits of role-playing in sales coaching?

How do financial advisors improve client engagement?

What is the cost of sales coaching services for financial advisors?

How can financial advisors improve their closing strategies?

What makes a sales coaching program effective?

Areas of practice: Financial Advisor marketing, financial advisor sales coaching, wealth management marketing, wealth management sales coaching, wealth management event planning, wealth management video content creation, wealth management website creation, search engine optimization for advisors, financial advisor branding, advisor niche marketing, advisor high net worth marketing, financial advisor job search, barron’s top advisor coaching, keynote speaking for advisors and wealth managers, wealth manager team offsites, wealth management modernization, wealth management marketing company, hedge fund marketing, third party marketing, marketing firm for advisory practices, best ways of spending your money on marketing, website design consultation, how to design your website as an advisor, how to focus on a niche in wealth management, niche marketing strategies, linkedin strategies for financial advisors, sales training bootcamp for financial advisors, E-learning solutions and online training/video library for financial security advisors, sales training RIAs and Sales Training Financial Advisors

Choosing the best coach for financial advisors can be a transformative decision in your professional journey. Investing in the right mentorship not only sharpens your technical skills but also enhances your ability to connect with clients, build lasting relationships, and scale your practice effectively. At Select Advisors Institute, we understand that every financial advisor's path is unique, which is why our coaching programs are tailored to meet your specific needs, goals, and challenges. Our expert coaches bring years of industry experience and proven strategies to help you overcome common hurdles like client acquisition, regulatory compliance, and market volatility with confidence and clarity.

By partnering with us, you gain access to cutting-edge resources, personalized guidance, and a supportive community dedicated to your success. Our approach integrates behavioral finance insights, goal-setting frameworks, and accountability measures that keep you focused and motivated. Whether you're an emerging advisor looking to establish your footprint or a seasoned professional aiming to refine your practice, our comprehensive coaching solutions equip you with the tools to thrive in an increasingly competitive landscape.

We also prioritize continuous learning, encouraging you to stay ahead of industry trends and technological advancements through ongoing education and skill development. This commitment ensures that you remain agile and responsive to client needs, expanding your influence and impact over time. Choosing the best coach for financial advisors means selecting a partner invested in your growth, equipped with the expertise to elevate your practice, and dedicated to helping you reach your highest potential. At Select Advisors Institute, we’re here to guide you every step of the way toward achieving remarkable results.

If you have any of these queries, contact us:

1. Who is the best coach for financial advisors?

2. How to find a financial advisor coach near me?

3. What are the top financial advisor coaching programs?

4. How can a coach help financial advisors grow their business?

5. What is the cost of coaching for financial advisors?

6. How do financial advisor coaches improve client relationships?

7. Are financial advisor coaching sessions available online?

8. What qualifications should a financial advisor coach have?

9. How long does financial advisor coaching take to show results?

10. Can coaching help new financial advisors build a client base?

11. How do I choose between different financial advisor coaches?

12. What coaching techniques are best for financial advisors?

13. Do financial advisor coaches provide personalized marketing strategies?

14. What are success stories from financial advisor coaching?

15. How often should a financial advisor meet with their coach?

16. Is group coaching effective for financial advisors?

17. What tools do financial advisor coaches use to track progress?

18. Can coaching help financial advisors with compliance and regulations?

19. Are there free resources for financial advisor coaching?

20. How to measure the ROI of financial advisor coaching?