You may be asking yourself or your team:

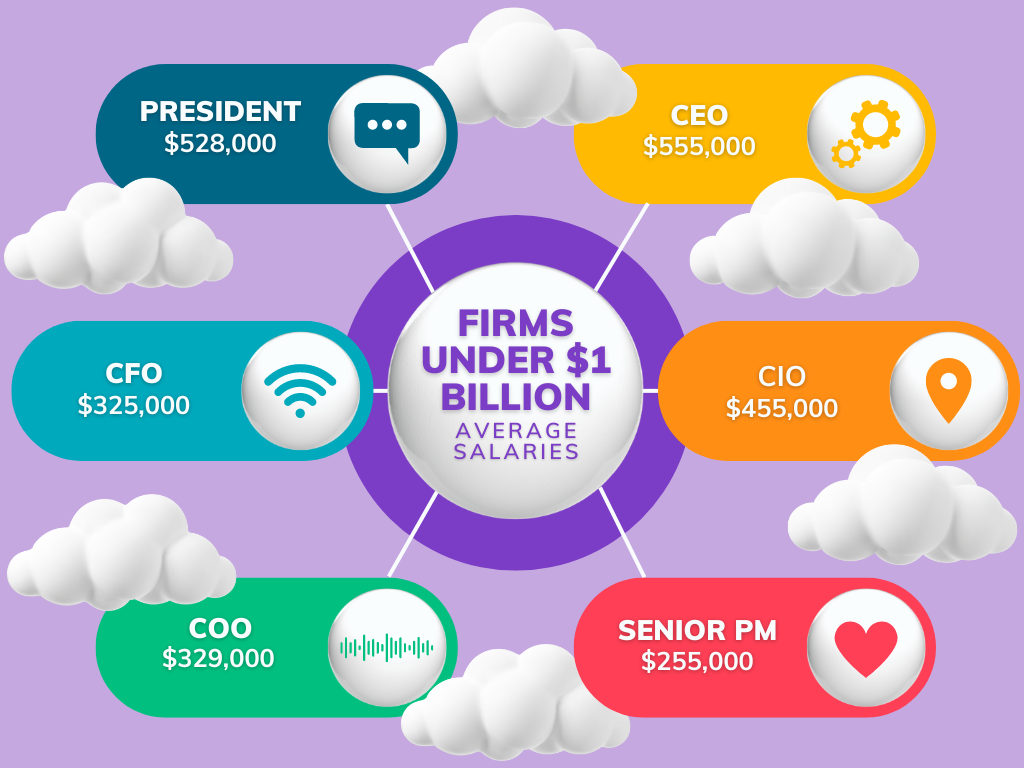

What is the going rate for a CEO at a financial advisory or wealth management firm?

What is the salary of a portfolio manager at a wealth management firms?

How much should I pay my analyst in wealth management?

Going rates of comp and salary in wealth management?

Well, we’ve got your answers!

While the listing below is an industry standard, comprised of our research from various resources including Morgan Stanley’s family office survey, it can give you some guidelines on how to think about wealth management compensation.

Want to see salaries for firms over $1 billion or other roles? Contact us today!

Please read below to learn about various compensation structures within this space.

Understanding Wealth Management Compensation: Structures, Trends, and Best Practices

Wealth management compensation continues to evolve, reflecting the complexities of financial markets, client expectations, and the need for firms to attract and retain top talent. Compensation structures are designed not only to motivate advisors but also to align their goals with the firm's objectives and client satisfaction.

RIA Compensation Models

Registered Investment Advisors (RIAs) are increasingly focusing on aligning compensation models with both firm growth and client outcomes. RIA compensation structures typically involve a combination of base salaries, bonuses, and sometimes equity incentives.

Hybrid Compensation Models: Many RIAs are adopting hybrid compensation models that blend base salaries with performance-based incentives. This approach ensures that advisors are motivated to grow their client base while maintaining high levels of service. It also addresses the need for stability in income, particularly important during market downturns or periods of economic uncertainty.

Tailored Compensation Structures

Customization in compensation structures is becoming more prevalent, especially among RIAs serving niche markets or specialized client bases. Tailored compensation models can include bonuses tied to specific client outcomes or milestones, such as reaching a certain level of assets under management (AUM) or achieving high client satisfaction scores.

Deferred Compensation Plans: Another trend is the use of deferred compensation plans, which reward advisors for long-term client retention and firm loyalty. These plans are particularly effective in reducing turnover and ensuring that advisors remain committed to the firm's long-term success.

Equity-Based Compensation

Equity-based compensation is increasingly used in RIA firms to align the interests of advisors with the overall success of the firm. By offering stock options, restricted stock units, or other forms of equity, firms can create a sense of ownership among advisors, encouraging them to focus on long-term growth and client satisfaction.

Profit-Sharing Models: Some RIA firms are also exploring profit-sharing models, where advisors receive a portion of the firm's profits in addition to their regular compensation. This approach can be particularly effective in smaller, boutique firms where collaboration and collective success are key to the firm’s growth.

Client-Centric Compensation

With the growing emphasis on fiduciary responsibilities, RIA firms are increasingly adopting client-centric compensation models. These models focus on aligning advisor incentives with client outcomes, such as investment performance, financial planning success, and overall client satisfaction.

Fee-Based Compensation: Fee-based compensation models, which charge clients based on a percentage of assets under management or a flat fee for services, are becoming more common. This approach reduces potential conflicts of interest and ensures that advisors are rewarded for providing value to clients rather than simply generating transactions.

Benchmarking and Surveys

To stay competitive, many firms rely on benchmarking and compensation surveys to assess how their compensation packages compare to industry standards. These tools help firms identify areas where they may need to adjust their offerings to attract and retain top talent.

Compensation Surveys: Regular participation in compensation surveys allows firms to stay informed about trends and shifts in the industry. By understanding how other firms structure their compensation packages, RIAs can make informed decisions about their own offerings, ensuring they remain competitive in attracting top advisors.

Conclusion

Wealth management compensation is a complex and evolving landscape, shaped by market dynamics, regulatory changes, and the need to attract and retain top talent. By understanding the key components of compensation structures and staying informed about industry trends, firms can design competitive packages that align advisor incentives with firm goals and client outcomes. Whether through hybrid models, equity-based compensation, or client-centric approaches, effective compensation strategies are essential for driving success in today's competitive financial services industry.

Integrating Sales and Business Development: As part of a comprehensive compensation strategy, firms should also consider integrating sales and business development incentives to encourage growth and client acquisition. This can include bonuses for new business generation or cross-selling services, ensuring that advisors are motivated to contribute to the firm’s expansion while maintaining high levels of client service.

Compensation benchmarking for financial advisors is essential for firms looking to attract and retain top talent. By evaluating industry standards and adjusting compensation packages accordingly, firms can remain competitive in a rapidly evolving market. Financial advisors, particularly those with specialized skills or strong client relationships, expect compensation that reflects their value to the firm. Regularly conducting compensation benchmarking helps ensure that financial advisors are being rewarded fairly, while also enabling firms to set competitive salaries that align with their business goals and the value they offer to clients.

Effective compensation benchmarking goes beyond simply matching industry averages. It involves a thorough analysis of various factors, including geographic location, experience, client base, and areas of expertise. The best benchmarking practices take into account both base salary and performance-based incentives, such as bonuses or profit-sharing opportunities. By considering these elements, firms can create compensation packages that not only attract top-tier financial advisors but also motivate them to perform at their highest level, ultimately benefiting both the advisor and the firm.

Additionally, compensation benchmarking allows firms to stay informed about emerging trends in the wealth management industry. With the rise of new technologies, changing regulations, and evolving client expectations, the landscape of financial advisory services is constantly shifting. By regularly reviewing compensation practices, firms can ensure that their pay structures remain aligned with industry trends and competitive forces. This proactive approach helps them stay ahead of the curve and continue to attract and retain the best financial advisors in the market.

At Select Advisors Institute, we specialize in compensation benchmarking for financial advisors, offering insights and strategies that help firms optimize their compensation structures. Our expert team works closely with firms to analyze market data and develop tailored compensation packages that meet both the needs of financial advisors and the business objectives of the firm. By leveraging our in-depth industry knowledge, we help firms create competitive compensation strategies that drive performance, enhance retention, and ensure long-term success. With our guidance, firms can confidently navigate the complexities of compensation benchmarking and position themselves as industry leaders.

Select Advisors Institute offers comprehensive coaching programs designed to transform your public speaking and presentation skills. Whether you're preparing for a high-stakes client meeting, a board presentation, or an industry event, our proven methods ensure you deliver with confidence and impact. Elevate your communication skills, build stronger client relationships, and unlock your full potential as a financial professional with Select Advisors Institute. Contact us today to get started.