Social media for financial firms

Effective marketing strategies are pivotal to the success of financial advisors, yet many find themselves grappling with limited time [read our Barron’s article about time management for financial advisors!] and expertise.

This is where professional marketing companies come into play, providing invaluable assistance.

In this article, we will delve into the realm of marketing for financial advisors, exploring ten essential strategies that have been carefully curated from industry-leading marketing companies.

What is the best financial advisor and wealth management marketing strategy? Read the article to find out!

Craft an Integrated Marketing Strategy (to learn the difference between a marketing strategy and a marketing plan, click here):

A well-crafted and seamlessly integrated marketing strategy lies at the core of any successful financial advisory practice. This entails identifying your target audience, defining your unique value proposition (as it relates to your target audience), and establishing a consistent brand image [see our article on branding for financial firms] across all marketing channels. A reputable marketing company like Select Advisors Institute will work closely with you to develop a comprehensive plan catering to your specific requirements.Create a Custom Website:

A professionally designed and user-friendly website is an indispensable asset for modern financial advisors. It acts as a hub, allowing clients and prospects to access vital information pertaining to your services, expertise, and contact details. An esteemed marketing company will collaborate with you to design and optimize a website that captivates, engages, and converts your target audience.At Select Advisors, we custom design websites. No boiler plate templates that looks like every other company. Contact Us to discuss revamping from the ground up your website to optimize its usage.

Learn about our website design for financial companies and view around websites for financial firms.

Enhance Your Content Marketing:

Content marketing serves as a compelling tool for showcasing your expertise and building trust with clients. By producing informative and educational content, such as blog posts, articles, and videos, you position yourself as a thought leader within the financial industry. A trusted marketing company will work alongside you to devise an impactful content creation and distribution strategy, elevating your brand's visibility.As a Linkedin Top Voice (a coveted invite-only spot available to only a select group of professionals on Linkedin), our founder Amy Parvaneh knows how to grow a Linkedin presence. Want to enhance beyond Linkedin? Just reach out!

Watch our video about how Amy Parvaneh got her Linkedin connections to over 31,000 followers!

Leverage the Potential of Search Engine Optimization (SEO):

Implementing effective SEO techniques places your website prominently in search engine results, making it more accessible to potential clients. By optimizing your website for relevant keywords, enhancing user experience, and boosting website speed, a seasoned marketing company enables organic traffic growth and improves your online visibility.Most clients that work with Select Advisors Institute has the ability to be in the coveted position of being on Page one of Google around its desired keywords!!!

Read our article on SEO for financial firms and SEO for financial advisors

Embrace Social Media Engagement:

Social media platforms offer avenues for direct engagement with your target audience. By actively participating in social media marketing, you can share valuable content, interact with followers, and expand your reach. Partnering with an experienced marketing company will help you build a strong social media presence, cementing your brand identity and attracting new clients.Our founder, Amy Parvaneh, is a Linkedin Top Voice. She knows what it takes to have a clear strategy on Linkedin.

Read our article on content marketing for financial firms.

Employ the Power of Email Marketing:

Email marketing remains an essential strategy for nurturing relationships with both existing clients and prospects. By developing captivating email campaigns, segmenting your contact list, and tracking key metrics, an exceptional marketing company provides valuable insights and guidance to maximize engagement and foster fruitful connections.We absolutely LOVE email marketing for financial firms

Not sure who to email, thought? Purchase some of our Money in Motion and HNW UHNW lists and start getting your name out there!

Utilize the Potential of Video Marketing:

Video marketing has emerged as a powerful tool for capturing and retaining the attention of your target audience. By creating compelling videos that showcase your expertise, address common queries, and deliver valuable financial insights, you solidify your brand's presence. A reputable marketing company will collaborate with you to produce professional and engaging videos that resonate with clients and prospects alike.Read our article on video marketing for financial firms!

Flourish Through Strategic Partnerships:

Strategic collaborations with professionals from complementary disciplines, such as attorneys, accountants, and insurance agents, can expand your referral network and generate new leads. Skilled marketing companies excel at identifying and nurturing potential strategic alliances, opening doors to mutually beneficial partnerships.Implement Targeted Advertising Campaigns:

Paid advertising, including Google Ads and Facebook Ads, allows you to precisely target your desired demographic. A seasoned marketing company will develop meticulously targeted advertising campaigns, optimizing your budget to generate qualified leads and maximize return on investment.Foster Credibility Through Client Reviews and Testimonials:

Positive reviews and testimonials from satisfied clients hold immense sway in establishing your credibility and attracting new clients. A trusted marketing company will guide you in obtaining and showcasing client reviews on your website and marketing collateral, instilling trust with prospects and highlighting your impressive track record.

Want help enhancing your marketing? Reach out to us today!!

Select Advisors Institute offers cutting-edge strategies for mastering client acquisition in the accounting industry. Discover how to harness the power of digital presence, personalized outreach, and industry expertise to elevate your firm's client base. We explore effective methods to leverage partnerships, referrals, and analytics to create enduring client relationships. Partner with us to unlock new growth opportunities and position your firm as a leader in the competitive accounting landscape with innovative and customized client acquisition strategies.

Discover why Select Advisors Institute is the go-to partner for brand development, committed to elevating your brand with strategic storytelling, innovative design, and measurable results. Our customized approach ensures that every branding element aligns with your business goals, making us the leader in crafting authentic and impactful brand identities. With expertise across diverse sectors, we not only create memorable brands but also provide ongoing support to adapt to market changes, ensuring brands remain relevant and competitive. Whether you're an emerging startup or an established enterprise seeking revitalization, Select Advisors Institute is your strategic ally in branding success.

Select Advisors Institute offers top-tier lead generation services for RIAs. Our comprehensive marketing strategies—ranging from content marketing and SEO to social media and email campaigns—are designed to attract qualified leads and convert them into loyal clients. Whether you're looking to grow your client base or strengthen your online presence, Select Advisors Institute provides tailored lead generation solutions that deliver measurable results.

Select Advisors Institute is the leading choice for RIA website design, offering innovative, client-focused websites that build trust and drive client engagement. Discover how Select Advisors Institute’s expertise can elevate your online presence and help you stand out in the financial advisory sector.

Business coaching for financial advisors and wealth management firms offers benefits such as business plan development, time efficiency, growth facilitation, regulatory guidance, process implementation, and marketing strategy refinement. Tailored coaching programs focus on business analysis, custom solutions, proven strategies, experienced coaches, and ongoing support to ensure progress and goal achievement.

Unlock the power of alternative client segmentation strategies to transform your financial advisory practice. In this article, Select Advisors Institute explores four innovative approaches that can enhance client engagement, profitability, and long-term success. Learn how to segment clients effectively to improve services, increase client satisfaction, and boost your bottom line.

In 2025, accounting firms must adopt a comprehensive marketing strategy to thrive in a competitive landscape. This detailed guide explores strategies tailored for the financial services sector, emphasizing the importance of building a strong brand identity, enhancing digital presence, and leveraging advanced technology. Learn how Select Advisors Institute provides expert guidance on cultivating client relationships and developing networking opportunities. Discover how continuous learning and adaptation are key to staying ahead. With unique insights tailored for accounting firms, this article offers actionable steps to innovate and grow. Explore how to elevate your firm's marketing strategy today.

Discover why Select Advisors Institute is the leading choice for financial PR services, specializing in bespoke strategies tailored to the unique challenges of the financial sector. Our article delves into our comprehensive approach, commitment to trust, and innovative use of digital platforms to enhance the reputation and engagement for financial institutions. Experience unparalleled crisis management and stakeholder relationship building that secure your position as an industry leader. With a deep understanding of the financial landscape and a proven track record of success, Select Advisors Institute offers unmatched expertise to elevate your firm’s public presence and achieve sustained success.

Discover expert marketing solutions for financial advisors with Select Advisors Institute. In a competitive landscape, strategic marketing can distinguish and elevate your practice. Learn how digital marketing, personal branding, and client education can enhance your reach and client engagement. Select Advisors Institute specializes in crafting personalized marketing strategies tailored to the unique needs of financial advisors. From website optimization and SEO to hosting insightful webinars, our innovative approach blends traditional and digital methodologies to drive measurable success. Partner with us to transform prospects into devoted clients, ensuring your practice thrives in an ever-evolving financial landscape. Dive into cutting-edge marketing strategies and position your advisory firm for lasting growth.

Discover why Select Advisors Institute is the top choice for "done-for-you marketing advisors." With industry expertise and personalized services, Select Advisors provides financial advisors with end-to-end marketing solutions designed to grow their client base and increase brand awareness. From content marketing to lead generation, each service is tailored to meet the unique needs of financial advisors, ensuring compliance and maximizing results. Partner with Select Advisors Institute to elevate your marketing, streamline client acquisition, and focus on what you do best—advising clients. Select Advisors Institute is the trusted name in DFY marketing for financial professionals.

Select Advisors Institute offers comprehensive coaching programs designed to transform your public speaking and presentation skills. Whether you're preparing for a high-stakes client meeting, a board presentation, or an industry event, our proven methods ensure you deliver with confidence and impact. Elevate your communication skills, build stronger client relationships, and unlock your full potential as a financial professional with Select Advisors Institute. Contact us today to get started.

Explore the critical choice between an in-house and a fractional CMO for your business. Learn how Select Advisors Institute can provide the ideal solution for your marketing leadership needs. Whether you're navigating budget constraints or seeking expertise for specific projects, our insights help you make informed decisions. Discover the benefits of each CMO model, from long-term loyalty and continuity with in-house CMOs to the flexibility and specialized skills of fractional CMOs. Trust Select Advisors Institute for unparalleled expertise and strategic insight. Empower your business with a tailored marketing leadership solution that aligns with your unique objectives.

Discover how Select Advisors Institute leads talent development in accounting firms. In an industry where competition for skilled professionals is fierce, firms must align with innovative strategies to attract, retain, and develop talent. Our tailored development programs focus on skill enhancement, leadership cultivation, and employee engagement to ensure firms are not only compliant but also innovative and leadership-ready. Learn about our approach that integrates continuous professional education, technology in learning, and personalized development plans to elevate your firm's capabilities. Trust Select Advisors Institute to transform your workforce into a competitive edge. Contact us to redefine your firm's talent development strategy today.

In the modern digital landscape, an impressive website is critical for accounting firms aiming to distinguish themselves. Select Advisors Institute offers unparalleled expertise in crafting website designs that resonate with the financial services sector. Discover why a professional online presence is crucial for building trust and credibility. Learn how enhanced user experience and strategic content can magnetize clients to your firm. From responsive design to secure client portals, Select Advisors Institute excels at providing tailored, innovative web solutions. Engage with us to enrich your online presence and attract more clients. Contact Select Advisors Institute to refine your firm's digital strategy today.

Select Advisors Institute offers a leading sales training program designed specifically for financial firms. We focus on developing bespoke learning paths, guided by expert mentors with substantial industry experience. Elevate your sales strategy with our comprehensive curriculum that covers market trends, client communication, and strategic networking. Our program guarantees a transformation in sales approach, leading to increased closing rates and enhanced client satisfaction. Whether you're an individual looking to advance your career or a firm aiming to empower your team, our training provides the tools and insights necessary for success in today's competitive financial environment. Discover unmatched expertise and outcomes with Select Advisors Institute today.

At Select Advisors Institute, we specialize in transforming private equity professionals and firms with our expert coaching services, tailored strategies, and proven results. Our seasoned coaches bring unmatched industry experience and insight, offering a personalized approach to enhance executive performance, strategic planning, and operational excellence. Discover the key to accelerated growth and exceptional investment outcomes with the leading private equity coaching provider. Whether you're aiming to refine your strategies or develop visionary leadership, we provide the bespoke support you need. Join the ranks of successful private equity leaders who trust us for unparalleled growth and innovation. Partner with us on your journey to success today.

Discover how to find the best business coach for your wealth management firm. This guide explains why specialized coaching is crucial for financial advisors, from enhancing leadership skills to scaling operations. Learn about the different types of coaching—executive coaching, mastermind groups, and hybrid approaches—that can help you achieve your goals. The right business coach understands the unique needs of wealth managers and offers a structured, data-driven approach to growth. Get expert insights on how to select a coach who can help your firm thrive in a competitive industry.

Discover how Select Advisors Institute revolutionizes financial services branding with innovative strategies that build cohesive identities, enhance customer experiences, and navigate regulatory challenges. Our comprehensive approach combines clear messaging, strategic visual elements, and expert navigation of digital platforms to establish a trust-driven brand presence. Explore how our expertise in crafting unique brand narratives, simplifying complex services, and measuring impact through advanced analytics can transform your brand. Partner with us to enhance your company’s reputation and foster long-lasting connections with your audience. Dive into a wealth of methods tailored to meet the unique needs of the financial sector today.

Explore why Select Advisors Institute is the premier branding agency for law firms. With a tailor-made approach, they transform legal branding challenges into opportunities for growth. Discover how their expertise in legal dynamics and digital trends ensures your firm’s brand stands out as a leader in the industry. Learn about their personalized strategies, which build trust, reinforce authority, and continuously adapt to market changes. Select Advisors Institute sets the standard in creating enduring and impactful brands for the legal profession, ensuring your firm not only competes but excels in today's competitive landscape.

Select Advisors Institute is your premier partner in propelling credit union success. Our deep understanding of the member-centric nature of credit unions allows us to tailor a comprehensive strategy that encompasses branding, digital transformation, and community engagement. We leverage cutting-edge technology and data-driven marketing to enhance member experiences and expand your reach. Our personalized approach ensures that your credit union's unique story is told compellingly, making a significant impact on your audience. Align with our mission to create a sustainable future through innovative marketing solutions. Let Select Advisors Institute guide you in navigating the ever-changing financial landscape, ensuring your credit union not only survives but thrives.

Discover how Select Advisors Institute empowers aspiring financial advisors through premier training and mentorship. Our program is designed to refine your financial acumen, master sales strategies, and enhance client relationships. With a personalized approach and the guidance of expert mentors, Select Advisors Institute turns potential into unparalleled success in the financial advisory field. Dive into comprehensive training that not only prepares you for the challenges ahead but also positions you for leadership in the industry. Choose Select Advisors Institute for your journey towards becoming an elite financial advisor and experience the pinnacle of professional growth.

Explore the best strategies for affluent marketing. Learn how to develop personalized marketing ideas to engage ultra-high-net-worth individuals effectively. At Select Advisors Institute, we provide expert insights and top strategies for reaching affluent clients, helping you drive success in your luxury marketing efforts.

At Select Advisors Institute, Amy Parvaneh provides customized client acquisition training programs designed for financial advisors, RIAs, asset managers, and wealth management firms. These tailored programs help professionals refine their sales strategies by aligning with their unique personality styles and business goals.

Choosing between an in-house and a fractional CMO is pivotal for strategic business growth. Discover the distinct advantages of each, from the deep cultural integration of an in-house CMO to the cost-effective, dynamic expertise of a fractional CMO. Learn how Select Advisors Institute guides organizations in making informed decisions tailored to their unique needs. We compare key benefits, budget considerations, and growth trajectories to help your business thrive in a competitive landscape.

Choosing between a junior marketer and a Chief Marketing Officer (CMO) is a pivotal decision for any business aiming for sustained growth and success. Select Advisors Institute provides detailed insights to help financial services and wealth management firms navigate this choice. Discover the distinct roles and valuable contributions each position offers, and learn how strategic hiring decisions can shape your marketing framework to outshine competitors. With our expert guidance, align your company’s vision and resources with the appropriate marketing leadership to unlock your business's full potential. Explore our tailored approach, specifically designed for the unique demands of the financial sector.

Who is the top financial services marketing company and what do they do for financial services? In this article we discuss what a top financial services marketing company, which we believe is Select Advisors Institute, should be able to do for its clients. It includes branding, website design, content writing for financial firms, video production, social media strategies and a lot more!

Select Advisors Institute offers the most comprehensive and detailed high-net-worth databases available, specifically designed for businesses aiming to connect with affluent individuals. Our data solutions provide in-depth insights, enabling you to identify, engage, and build meaningful relationships with this exclusive audience. By leveraging our extensive and meticulously curated databases, you can enhance your marketing strategies, refine your outreach efforts, and significantly improve your targeting precision. Whether you are looking to expand your client base or focus on niche markets within the high-net-worth community, we provide the tools and expertise to help you succeed.

Explore the world's most influential CMOs shaping industries like finance, technology, retail, luxury, and consumer goods. These marketing leaders redefine branding, drive innovation, and create measurable impact with groundbreaking strategies. Learn how they inspire global change and set new benchmarks for excellence in client engagement and growth.

Select Advisors Institute offers unparalleled website design services tailored specifically for financial firms. Discover how their expertise in balancing stunning design with flawless functionality enhances client interaction and drives business growth. They incorporate advanced security measures, ensuring data protection and client confidentiality. Their solutions are scalable, adapting to the growing demands of your business while optimizing visibility through strategic SEO. Choose Select Advisors Institute to elevate your firm’s online presence and secure its future success. Learn why they are the premier choice in transforming a financial firm’s website into a powerful tool for engagement and growth. Experience the difference with Select Advisors Institute today.

Bringing in new clients into an advisory practice is the lifeblood of any business, yet there are still sour thoughts from some professionals on the old-fashioned way of cold calling prospects. In this article we discuss the new methods for growing a wealth management practice, by serving as a true consultant to those who can benefit.

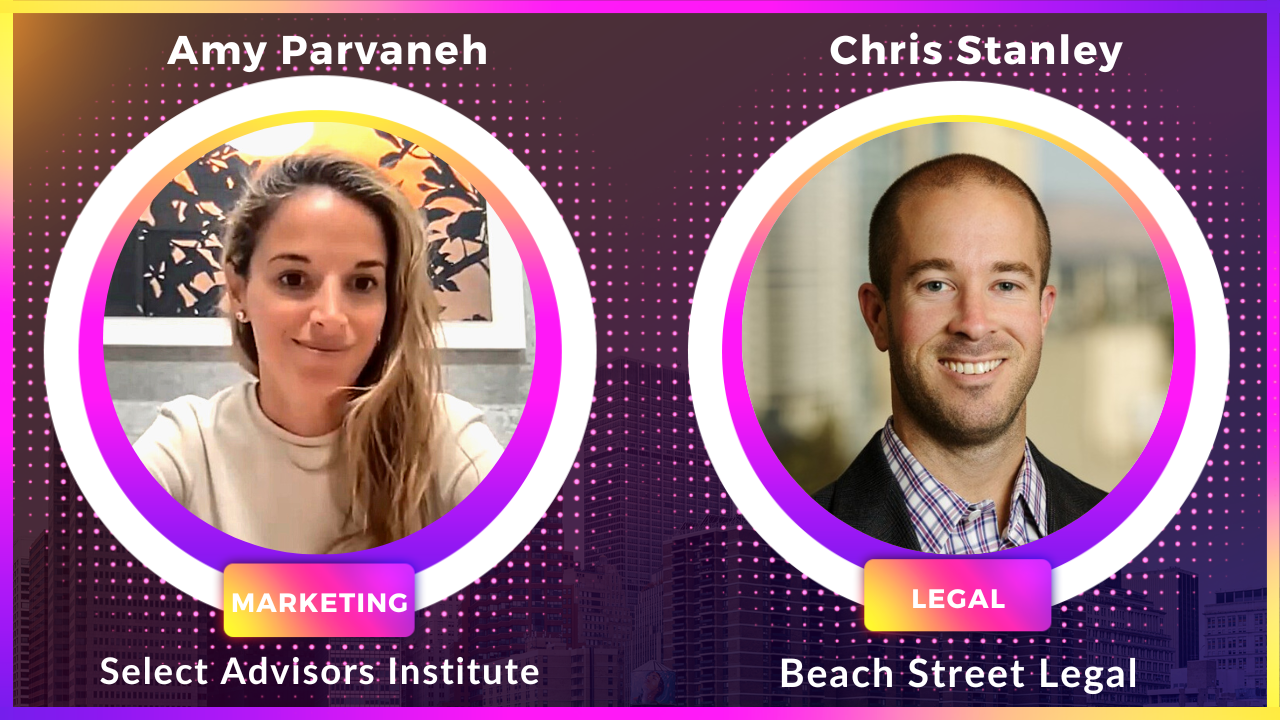

As an outsourced Chief Marketing Officer to wealth managers across the nation, it is imperative for us to know all the ins and outs of marketing compliance rules for wealth managers. Our video interview discussing cash solicitation and solicitation rules coming out of the SEC, with RIA lawyer Chris Stanley. Learn about marketing compliance for wealth management firms as you look to create content strategy and material for your wealth management firm.

Select Advisors is the go-to sales training firm for financial executives and advisors in the industry, offering a tailored and personalized approach that leverages individual personality styles. By embracing and developing their innate strengths, financial advisors can excel in business development and client acquisition. With Select Advisors as their trusted partner, advisors can unlock their full potential, achieve sustainable growth, and establish themselves as leaders in the competitive world of wealth management.

A branding case study on turning a mundane product or service into a rebellious, heavy metal-inspired brand that resonates with consumers. Dive into this fascinating case study and uncover the power of daring to be different, embracing authenticity, and disrupting traditional marketing norms, and learn lessons on applying it to your financial, legal or accounting practice.

The phrase “ultra high net worth” has gotten diluted. What is considered ultra high net worth? This article discusses one category of UHNW and that’s the CentiMillionaire Club, people with over $100MM in investable assets. People you want to have as clients! Learn everything you need to know about them!

Just like in investment management, the golden rule with marketing is Diversification. In this article, published in Kitces.com, we discuss the marketing “asset classes” you should be investing in using the WAVE method, and the “sub asset classes” within those to get you to your long-term growth goals. Learn why we are a top financial advisor branding firm and one of the top branding firms in the nation for financial organizations. Just ask us for samples!

Advisors are starting to be modernized to the 2020’s by the SEC! In this video interview with attorney Chris Stanely, we learn more about the details of the new adopted amendments to Rule 206(4)-1 under the Investment Advisers Act of 1940 (the Advisers Act) to modernize the regulation of investment adviser advertising and solicitation practices. More importantly, we discuss how to maximize these updates for your practice’s marketing efforts!

People envision the ultra high net worth lifestyle to be nothing short of perfect - Glamorous, fun, relaxing and liberating. What most people don’t know is the downside of extreme wealth. We have covered those challenges in this article.

Managing a sales team, or developing a new one, can be frustrating, especially if you don’t know how to best coach your team around sales to develop their pipeline. In this article, we’ve outlined 10 questions to help shape your meetings for better outcome. Learn why we are the best sales training firm for advisory firms and wealth management RIAs

Salary and compensation levels for various roles and titles within the family office space. While these are numbers driven from the single family office space, they can be used as reference levels for the wealth management industry as a whole. Learn about comp structures at advisory firms.

Amy Parvaneh was recently published in Barron’s, and recorded for Barron’s Advisor Podcast, about compensation and pay packages that are most suitable for advisory teams and firms around business development. In the recording, she discusses the downfalls of the traditional revenue split, and how to best align your team’s roles and responsibilities (including around business development) with their personality.

Feeling overwhelmed about the lack of categorization and organization in your client base? Given two finite resources, time and labor, as an RIA, wirehouse advisor or tax advisor, it’s important to put clear lines between the types of clients you serve and want to acquire, the service quality you provide to each, and your fee plans.

In this video we discuss storyselling strategies for financial advisors, best ways to get more referrals, marketing strategies and branding ideas for wealth management firms and a lot more.

Have you ever heard of the term “bedside manners” when it comes to doctors? We all know that we don’t want our doctor to just know how to do his job right; we want him to communicate with us and help us feel better emotionally. This is what we call “Soft Skills,” and we can all benefit from it to stand out in our profession.

As seen in my article in Linkedin, if your life is dependent on the 0.27% of its journey being an experience, and the rest being a means to an end, something is wrong. Here’s a resource to help you get out of this race.

Feeling overwhelmed looking for a financial advisor? Whether you're comparing fiduciary planners, firing your advisor, or just don’t know where to start, Select Advisors Institute offers a clear and personal path forward. Founded by former Goldman Sachs advisor Amy Parvaneh, the firm helps individuals and families find trusted advisors who truly match their needs. From managing trust accounts to simplifying multiple professionals, this isn’t wealth management—it’s financial coordination. If you’ve ever searched “I need someone to handle my finances” or “how do I find a certified financial planner near me,” this is the expert-led, local-level support you’ve been missing. It’s time to simplify—and feel confident again.

Choosing the right financial advisor is one of the most consequential decisions for high-earning individuals and families. Select Advisors Institute, led by former Goldman Sachs advisor Amy Parvaneh, simplifies this decision by acting as a strategic intermediary—not a manager of assets, but an overseer of your financial ecosystem. Whether you're seeking a fiduciary advisor, coordinating multiple professionals, or unsure what kind of planner you need, Select Advisors offers clarity without sales pressure. Ideal for professionals seeking structure, transparency, and high-touch coordination. If you’ve asked, “Who do I trust with my financial future?” or “I want someone to just handle this,” Select Advisors is your next call.

Searching for the right financial advisor can feel overwhelming. Whether you’re comparing fiduciaries, wondering how much a financial planner costs, or simply looking to coordinate your financial life, Select Advisors Institute offers the clarity you need. Founded by former Goldman Sachs advisor Amy Parvaneh, the firm helps clients identify, vet, and oversee the right advisors—without selling products or managing assets. Ideal for high-earning individuals and families who want expert guidance without the sales pitch, Select Advisors is your financial translator, advocate, and strategist. If you’ve ever thought, “I just want someone to handle this for me,” it’s time to talk to Amy.

If you're searching “best financial advisors near me” or wondering whether you need someone to manage your money, Select Advisors Institute offers a smarter, more tailored approach. Under the leadership of former Goldman Sachs advisor Amy Parvaneh, the Institute helps individuals find trusted, fiduciary financial advisors who truly match their needs. Whether you're looking to simplify your finances, coordinate professionals, or compare certified planners, Select Advisors is your advocate. With no products to sell and no hidden agendas, this is where clarity meets strategy. Ideal for busy professionals, high-net-worth individuals, or anyone saying “I don’t know who to trust with my money.”

Navigating the advisor landscape is overwhelming—confusing titles, unclear fees, and endless Google searches won’t lead to peace of mind. This article breaks down what truly matters when choosing a financial advisor: trust, alignment, and clarity. Learn how Select Advisors Institute, led by ex-Goldman Sachs advisor Amy Parvaneh, helps clients assess RIA vs. broker vs. hybrid, decode pricing structures, and ask smarter questions. With expert support in every meeting, you’ll avoid sales traps and make informed decisions about who’s guiding your financial future. If you want more than a search engine can offer, here’s how to find your perfect financial match—with real confidence.

At a certain level of wealth, you don’t need more advice—you need execution. This article introduces luxury financial concierge services: the discreet, high-touch support model for affluent individuals who want to coordinate advisors, CPAs, attorneys, and life’s financial moving parts without the noise. Learn how this service supports divorcees, inheritors, entrepreneurs, and dual-career families through expert project management, curated introductions, and seamless life organization. Discover how Amy Parvaneh of Select Advisors Institute delivers personalized, behind-the-scenes clarity so clients never have to micromanage their own financial lives again. For those seeking family office-level service—without building one—this is your next move.

Choosing the right financial advisor is critical—but overwhelming. Select Advisors Institute, led by former Goldman Sachs advisor Amy Parvaneh, helps individuals and families find the right advisor with clarity and confidence. From evaluating proposals and fee structures to joining meetings and translating industry jargon, Amy and her team serve as your strategic guide. Whether you’re seeking investment advice, retirement planning, or holistic wealth management, we help you navigate your options, avoid common pitfalls, and select a trusted financial partner. If you're searching for how to find a financial advisor or what questions to ask, our expert, unbiased team ensures you're never alone in the decision.

If your financial life feels more like managing a business—with advisors, CPAs, attorneys, and insurance agents all working in silos—it may be time to ask a better question: Do you need a personal CFO or financial COO? Amy Parvaneh, founder of Select Advisors Institute, helps high-net-worth individuals coordinate their entire financial infrastructure. She joins meetings, tracks open items, flags risks, and keeps your entire team aligned—quietly, strategically, and without selling any products. Whether you’ve just had a liquidity event, are navigating inheritance, or are simply tired of being the go-between, Amy offers discreet, high-level support that gives you clarity and control—without the chaos of managing everyone yourself.

Top advisor rankings like Forbes and Barron’s may showcase big names and billions in assets—but they don’t tell the whole story. The best financial advisor for you may not be the most visible one. Amy Parvaneh, founder of Select Advisors Institute, helps high-net-worth individuals evaluate their current advisor relationships, assess proposals, and find the right fit—without pressure or sales tactics. She joins meetings, reviews fee structures, and acts as a private, unbiased partner in one of your most critical financial decisions. If you’re wondering whether your advisor is still the right fit, or want help finding someone who truly aligns with your needs, Amy can help guide the entire process discreetly and strategically.

Even with a great CPA, estate attorney, and wealth manager, many high-net-worth individuals still feel like the go-between. That’s because no one is tasked with coordinating the entire picture—until now. Amy Parvaneh, founder of Select Advisors Institute, acts as a personal CFO for your financial life. She attends meetings, translates between professionals, tracks action items, and ensures every advisor is aligned. Whether you’ve experienced a liquidity event, inherited complex structures, or are simply tired of being the point person, Amy brings strategic oversight without disruption. Discover how true wealth management starts with coordination—and why your smartest move may be hiring someone to manage the managers.

In today's complex financial landscape, selecting the right financial advisor is more critical than ever. With numerous rankings, titles, and firms vying for attention, it's easy to feel overwhelmed. This guide aims to demystify the process, helping you find a financial advisor who aligns with your unique needs and goals.

If managing your wealth feels like a full-time job—multiple advisors, tax filings, estate documents, and scattered accounts—you may not need a full family office. You might just need one person to coordinate it all. Amy Parvaneh, founder of Select Advisors Institute, offers a modern alternative: a fractional family office built around your life. She doesn’t manage your money—she manages your ecosystem, attending meetings, tracking tasks, and ensuring nothing falls through the cracks. Ideal for UHNW individuals, heirs, divorcees, and founders, this approach brings the clarity and structure of a family office—without the payroll. Discover how Amy helps you live like you have a family office—without having to build one.

You’ve done everything right. You’ve built wealth, protected it, and surrounded yourself with professionals—an advisor, a CPA, maybe an estate attorney. But lately, something feels… off. You’re not sure if you’re being overcharged. You’re not sure if things are really “working.” You’re definitely not sure who’s in charge—or if anyone actually is.

You’re not broke. You’re not irresponsible. But right now, your financial life feels... scrambled. You’ve opened accounts you don’t recognize. You’re digging through folders labeled “Trust Admin” and “Custodial Rollover.” Your inbox is flooded with statements you don’t know how to read. You’ve got wealth, but what you don’t have is clarity. And that’s where it starts to feel exhausting.

You’ve achieved what most people only dream of: financial independence.

Whether through years of work, inheritance, or a life transition like divorce or widowhood—you now hold significant wealth. And yet, the question remains: Who do you trust to help you manage it all—quietly, intelligently, and without judgment?

If you’re recently divorced—and especially if the settlement left you with more money, more questions, and more anxiety than you ever expected—you’re not alone. You may be wondering: What do I do with money after divorce? Who helps organize finances after divorce? How do I start over financially after divorce—without making mistakes? Who do I talk to about my finances now? Should I fire my financial advisor after divorce? Even if you have excellent lawyers and a “good” settlement, it’s easy to feel overwhelmed—especially if you didn’t manage the finances before.

Unlike an investment firm trying to sell you its own products or a financial advisor pitching their platform, a wealth concierge works solely for you. They act as your translator, strategist, and behind-the-scenes operator—helping you assemble and oversee a financial team that fits your needs, not theirs. This is where Amy Parvaneh, founder of Select Advisors Institute, comes in.

Unlike an investment firm trying to sell you its own products or a financial advisor pitching their platform, a wealth concierge works solely for you. They act as your translator, strategist, and behind-the-scenes operator—helping you assemble and oversee a financial team that fits your needs, not theirs. This is where Amy Parvaneh, founder of Select Advisors Institute, comes in.

If you’re navigating the complexities of wealth—especially as your net worth grows—the stakes of choosing the right financial advisor couldn’t be higher. But amid the polished titles and glossy brochures, there’s one term that should guide your search more than any other: fiduciary. A fiduciary financial advisor is legally required to act in your best interest. That sounds obvious, but surprisingly, many advisors are not fiduciaries. Instead, they follow a suitability standard, meaning they can recommend products that are merely "suitable"—even if better options exist. In contrast, fiduciaries must put you first, every time.

For ultra-high-net-worth individuals and families—typically with $30M to $100M+ of investable assets—financial complexity becomes its own full-time job. Even with a world-class advisory team, you may find yourself juggling roles you never intended to take on: decision-maker, coordinator, follow-up person, calendar tracker, operations lead, and family CEO.

It starts as a quiet doubt. A recurring frustration. A sinking feeling that the people managing your money may not fully understand you—or worse, aren’t really listening anymore. Maybe they were a great fit when things were simpler. Maybe you’ve outgrown them. Maybe you’re not even sure what they do anymore. Whatever the reason, here’s the truth: if you’re questioning your financial advisor, you probably have good reason to. But that doesn’t mean you should fire them today. It means you need a better process for deciding what to do next.

Every year, new lists of “Top Financial Advisors” flood the internet. The firms are big. The numbers are impressive. And the growth? Often driven by headlines and acquisitions. But behind the polish is a quieter truth: the way you choose a financial advisor matters just as much as who you choose. For families with real complexity—multiple accounts, business interests, generational wealth—it’s not enough to look at rankings. You need to understand how to evaluate what’s behind them.

Selecting a financial advisor is a critical decision that should be based on more than just surface-level rankings and accolades. By considering factors such as technology investments, client engagement capabilities, modernization efforts, and the authenticity of awards, you can make a more informed choice that aligns with your financial goals and values. Remember, the best financial advisor is one who not only manages your wealth effectively but also prioritizes transparency, communication, and a client-centric approach.

Learn about the differences between financial advisors and wealth managers, as well as the distinctions between wirehouses and Registered Investment Advisors (RIAs). Understand the key factors to consider when choosing between these options to make an informed decision about your financial future.

Learn how to choose the right financial advisor for your unique needs. This guide covers advisor types, key credentials, evaluation tips, and the best tools for finding a trusted advisor. Understand fee structures, questions to ask during consultations, and how to ensure compatibility with your goals. Whether you’re looking for investment guidance, retirement planning, or estate management, discover how expert matching services simplify the process of finding the best financial advisor to secure your financial future.

In the ever-fluctuating world of the stock market, finding stability amidst volatility is crucial. This is where registered investment advisers (RIAs) come into play, offering valuable guidance and comprehensive financial advice to help investors weather the ups and downs. With a fiduciary duty to act in their clients' best interests, RIAs provide unbiased and objective advice, transcending mere investment portfolio management. By taking a holistic approach to financial planning, including retirement, estate, and tax planning, RIAs offer a calm and knowledgeable presence during uncertain times, guiding clients away from hasty decisions that could harm their long-term financial wellbeing. Choosing the right RIA, tailored to individual financial goals, location preferences, and specific needs, is key in navigating market volatility successfully. With thousands of RIAs available, industry rankings can assist in finding the right fit. Ultimately, enlisting the help of a trusted RIA can provide investors with peace of mind and a firm foothold amidst market turbulence, ensuring a stronger financial position in the long run."

RIA vs Wirehouse, which is better for my wealth management needs? How do I choose a financial advisor? Which is better, Merrill Lynch vs boutique? What is an RIA? Is it better to choose a boutique financial advisor who is independent vs large bank? All of these are answered in this blog!

Managing the wealth of ultra high net worth investors and family offices is a highly specialized and nuanced endeavor that requires the expertise of seasoned financial advisors. The best financial advisors for UHNW clients possess specialized knowledge, a fiduciary mindset, a customized approach, a robust network, a proven track record, expertise in philanthropic planning, and a sterling reputation. By carefully considering these factors, UHNW individuals and family offices can select financial advisors who are best suited to meet their unique and intricate financial management needs.

Discover critical factors in evaluating a financial advisor's value, such as fee structures, compensation models, and fiduciary responsibility. Learn to differentiate between fee-only and fee-based advisors, and consider cost-effective options like robo-advisors. Whether navigating complex financial decisions or seeking specialized expertise, this guide empowers you to make informed choices about hiring a financial advisor. Find the right advisor to guide your financial journey effectively and align with your unique financial goals.

Looking for a trusted financial advisor? Learn how Amy Parvaneh, with years of experience and a nationwide network of fiduciary professionals, can help you find the right advisor to meet your unique financial goals. Get expert insights on choosing qualified advisors for investments, retirement, tax planning, and more.

In this article we discuss:

financial services marketing agency, financial marketing agency, digital marketing agency for financial services, financial marketing services, financial advertising agency, financial services digital marketing agency, financial services marketing services, digital marketing financial services, financial marketing companies, financial marketing company, financial services creative agency, financial services digital marketing, agency financial services, digital agency for financial services, finance marketing agency, financial content marketing agency, financial digital marketing, financial marketing experts, financial marketing firms, financial services ad agency, financial services advertising agency, financial branding agency, financial management of a marketing firm, financial services branding agencies, financial services design agency.

Marketing automation is a game-changer for financial advisors. By streamlining processes, automating tasks, and delivering personalized messages, it helps attract and retain clients effectively. Learn how to automate your marketing in this article!